Source of graph: online version of the WSJ article quoted and cited below.

Source of graph: online version of the WSJ article quoted and cited below.

(p. A3) In this year’s election, candidates have focused blame for rising income inequality on broad economic forces, from globalization to the decline of the American manufacturing base. But a growing body of research suggests a more ordinary factor: the price of the average single-family home for sale, from Fairfield, Conn., to Portland, Ore.

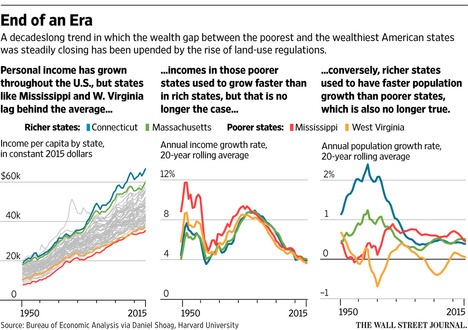

According to research by Daniel Shoag, an associate professor of public policy at Harvard University, and Peter Ganong, a postdoctoral fellow at the National Bureau of Economic Research, a decadeslong trend in which the income gap between the poorest and richest states steadily closed has been upended by growth in land-use regulations.

Moving to a wealthier area in search of job opportunities has historically been a way to promote economic equality, allowing workers to pursue higher-paying jobs elsewhere. But those wage gains lose their appeal if they are eaten up by higher housing costs. The result: More people stay put and lose out on potential higher incomes.

. . .

Messrs. Shoag and Ganong looked at mentions of “land-use” in appeals-court cases and found the number of references began rising sharply around 1970, with some states seeing a much larger increase than others. For example, the share of cases mentioning land use for New York rose 265% between 1950 and 2010 and 644% in California during the same period. By contrast, it increased by only 80% in Alabama.

For the full story, see:

LAURA KUSISTO. “Land Use Rules Under Fire.” The Wall Street Journal (Weds., Oct. 19, 2016): A3.

(Note: ellipsis added.)

(Note: the online version of the story has the date Oct. 18, 2016, and has the title “As Land-Use Rules Rise, Economic Mobility Slows, Research Says.” A few extra words appear in the online version quoted above, that were left out of the print version.)

The research by Ganong and Shoag, mentioned above, is:

Ganong, Peter, and Daniel Shoag. “Why Has Regional Income Convergence in the U.S. Declined?” Harvard University, John F. Kennedy School of Government, Working Paper Series, Jan. 2015.