Category: Nebraska

Democratic Donor Warren Buffett Praises DOGE

(p. A1) . . . at the end of Saturday’s Berkshire Hathaway annual meeting, the Oracle of Omaha dropped a bonbshell before a gathering of some 17,000 shareholders: that he’s set to step aside as Berkshire CEO, with vice chairman Abel taking his place.

. . .

(p. A4) It was little surprise that the very first question from moderator Becky Quick of CNBC in the Saturday [May 3, 2025] Q&A had to do with tariffs.

. . .

While critical of Trump’s tariffs, Buffett had little bad to say about Trump’s budget and program-slashing Department of Government Efficiency.

He called the current 7% gap between the federal government’s revenues and expenditures unsustainable. Whether that’s two or 20 years “it’s something that cannot go on forever,” he said. And if it isn’t brought under control, he said, it risks rampant inflation.

“I think it’s a job I don’t want, but it’s a job I think should be done, and Congress doesn’t seem to be doing it,” Buffett said.

For the full story, see:

(Note: ellipses, and bracketed date, added.)

(Note: the online version of the article has the title “Warren Buffett stepping down as Berkshire Hathaway CEO at end of year; shareholders react.”)

Medicare Bureaucrats Let Pretty in Pink Boutique Defraud Taxpayers

Fraudsters are scamming the Medicare bureaucracy out of billions of taxpayer dollars. How boldly audacious the fraudsters are. They don’t even bother to give their fraudulent catheter supply firm a plausible name. Pretty in Pink Boutique? Are the fraudsters high, are they stupid, or do they take malicious pleasure in seeing how far they can go and still get away with it? And who is working for the Medicare bureaucracy? Are they simply bitter because they work for a bureaucracy that neither rewards competent hard work, nor punishes incompetent dereliction of duty? Does anyone in the government know the meaning of the phrase “due diligence”? Does anyone care? Congress creates the incentives and constraints and so is more responsible than the bureaucrats. The article quoted below gives one more example of why we flourish when free enterprise grows and government shrinks.

Yes I take this personally–my identity was stolen by fraudsters borrowing government Covid money in my name for an alleged potato farm. Of course the truth is more complicated than my rant implies. Bureaucrats can be conscientious and entrepreneurs can be corrupt. But I do believe that the incentives and constraints of government bureaucracy encourage corruption, or at least lethargic inertia. And the incentives and constraints of free enterprise encourage conscientious hard work and innovative dynamism.

(p. A1) Linda Hennis was checking her Medicare statement in January [2024] when she noticed something strange: It said a company she had never heard of had been paid about $12,000 for sending her 2,000 urinary catheters.

But she had never needed, or received, any catheters.

Ms. Hennis, a retired nurse who lives in a suburb of Chicago, noticed that the company selling the plastic tubes was called Pretty in Pink Boutique, and it was based in Texas. “There’s a mistake here,” Ms. Hennis recalled thinking.

She is among more than 450,000 Medicare beneficiaries whose accounts were billed for urinary catheters in 2023, up from about 50,000 in previous years, according to a new report produced by the National Association of Accountable Care Organizations, an advocacy group that represents hundreds of health care systems across the country. The report used a federal database of Medicare claims that is available to researchers.

The massive uptick in billing for catheters included $2 billion charged by seven high-volume suppliers, according to that analysis, potentially accounting for nearly one-fifth of all Medicare spending on medical supplies in 2023. Doctors, state insurance de-(p. A15)partments and health care groups around the country said the spike in claims for catheters that were never delivered suggested a far-reaching Medicare scam.

. . .

Catheters and other medical supplies are frequent targets of billing schemes. Last April [2023], the federal government brought criminal charges against 18 defendants who had submitted bills for nonexistent coronavirus tests and other pandemic-related services. And in 2019, the Department of Justice said it had broken up an international fraud ring involving more than $1 billion in phony billing for back and knee braces.

. . .

Patients and doctors who have been reporting mysterious catheter claims to Medicare for months say they are frustrated by a lack of communication from the government about whether billions of dollars have been lost to an ongoing billing scam.

One of the advocacy group’s members, Dr. Bob Rauner, runs a large network of doctors in Nebraska. In an interview, he said his patients had been collectively billed nearly $2 million in 2023 for phantom catheters. (He tracks such spending because his organization gets bonus payments from Medicare when patients have good health outcomes with low overall medical spending.)

. . .

The vast majority of the suspicious claims identified by the new analysis came from seven companies, many of which have shared executives, according to public documents and the advocacy group’s report. Only one of the businesses had a working phone number, and it did not return a request for comment. The other numbers were either disconnected, went to different businesses or, in one case, went to a previous owner.

Pretty in Pink Boutique is registered with Medicare to a street address of a house in El Paso. Its phone number goes to an auto body shop called West Texas Body and Paint, where an employee who answered a call from a reporter said the shop receives “calls all day, every day” from Medicare enrollees concerned about fraudulent bills.

Pamela Ludwig runs an unrelated business in Nashville that is also called Pretty in Pink Boutique. She has received so many catheter complaints that she added a page to her website explaining that her business was not part of any scam.

“I have people calling me, cussing, screaming,” Ms. Ludwig said. “They feel violated.”

For the full story see:

(Note: ellipses, and bracketed years, added.)

(Note: the online version of the story has the date Feb. 9, 2024, and has the title “Staggering Rise in Catheter Bills Suggests Medicare Scam.”)

Diamond Op-Ed on Volunteering to Work the Polls on Nov. 5

My op-ed is: Diamond, Arthur M. “A Draft Avoider Finally Works the Polls.” The Wall Street Journal (Thurs., Oct. 31, 2024): A13. The op-ed title was written by the editors, not by me.

Not All Indians Were Peaceful Saints

As I child I played cowboys and Indians. We used to fire the fake rifles at the frontier fort on Tom Sawyer Island in Disneyland. Today you cannot do that since it is politically correct to believe that before the arrival of universally evil Europeans all Indians were peace-loving environmentalists. The belief is false. But The Walt Disney Company in California has bought the falsehood, closing the Disneyland frontier fort so that children can no longer pretend to defend civilization. (In Florida, where civilization yet survives, The Walt Disney Company still allows children to play in the Magic Kingdom version of the frontier fort.)

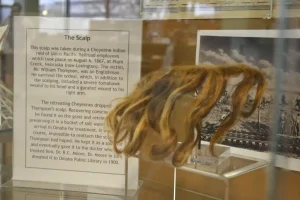

(p. E1) I’m leading off with my nomination for the most bizarre item ever exhibited in Omaha. It’s been around for more than 150 years, and it’s a shame if you haven’t seen it–that is, as long as you’re not too squeamish It used to belong to William Thompson, an Englishman who was employed by Union Pacific on the new transcontinental railroad.

In 1867, while working at Plum Creek Station, near Lexington, Nebraska, Thompson was scalped by a band of the Northern Cheyenne. He was left for dead, but when he recovered consciousness, he found his scalp not far away. Remarkably, he put it in a bucker of salt water and headed to Omaha on a rescue train. On arrival he asked Dr. Richard Moore to reattach it. That wasn’t possible, so he kept it as a souvenir. Later he gave the preserved scalp to Moore, who donated it to the Omaha Public Library in 1900. Since then, it has been exhibited from time to time at both the old Union Pacific Museum and the main library. OPL took it off public exhibit in 1977, but it made a surprise appearance in 2012 for the library’s 140th anniversary celebration. I am grateful to library specialist Lynn Sullivan for a private showing last year of the desiccated scalp, complete with a nice shock of sandy-orange hair.

For the full story see:

Marks, Bob. “Weird, Wild and Wonderful Exhibits Here.” Omaha World-Herald (Sunday, March 21, 2024): E1-E2.

Nebraska Interest Cap Regulation Reduced Consumer Payday Loan Options

(p. A1) Nebraska’s payday lenders have all shut down in the two years since voters capped the interest rate they could charge.

The last handful gave up their delayed-deposit services business licenses in December [2021], according to records kept by the Nebraska Department of Banking and Finance.

Just six months earlier, there had been 19 such businesses.

. . .

. . ., Ed D’Alessio, executive director of INFiN, a national trade association representing delayed-deposit businesses, said the closures were predictable, based on the experience of other states that have imposed similar rate caps.

“Nebraska’s 36% rate cap on delayed-deposit loans was never about consumer protection,” he said. “It was about activists’ thinly veiled desire to eliminate a regulated service valued by many.

“But Nebraskans’ need for credit did not go away. Instead, they have been left with fewer options for managing their financial obligations,” D’Alessio said. . . .

Payday loans, also known as cash advances, check advances or delayed-deposit loans, are a type of short-term, high-cost borrowing that people use to get small amounts of immediate cash.

For the full story, see:

(Note: ellipses, and bracketed year, added.)

(Note: the online version of the story was updated Oct. 18, 2023 [sic], and has the title “Payday lenders disappeared from Nebraska after interest rate capped at 36%.”)

Highly-Taxpayer-Subsidized Lincoln Airline Collapses After Three Months

The “American Rescue Plan Act” was also called the “Covid-19 Stimulus Package” or the “American Rescue Plan.” (To paraphrase Shakespeare on a rose: a “boondoggle” by any other name smells just as foul.)

(p. B2) LINCOLN — Red Way, the startup airline that had been providing service from Lincoln to destinations such as Las Vegas and Orlando, is ceasing operations at the end of the month.

. . .

The Lancaster County Board issued a written statement Wednesday [Aug. 23, 2023], saying it “is deeply disappointed and troubled at this unexpected and sudden turn of events.”

The board said there are “many unanswered questions regarding the Red Way project, (and it) looks forward to receiving a full accounting of this situation as the Lincoln Airport Authority charts a new path forward to serve our community.”

Board member Matt Schulte lamented the $3 million in lost American Rescue Plan Act funds — $1.5 million each from Lancaster County and the City of Lincoln — but called the air travel experiment a chance worth taking.

“I personally voted for this project believing that the air service would develop long term service,” he said. “Unfortunately, it didn’t work. I hope this failed experiment does not have a negative impact on the ability to expand service to the city of Lincoln.”

. . .

Airport officials had seemed optimistic about the airline’s prospects, noting that it had sold 10,000 tickets in just its first two weeks of operation.

In fact, Red Way flew just over 13,000 total passengers in June and July.

But cracks had started to show recently.

Red Way announced in July that it was dropping seasonal flights to Atlanta, Austin and Minneapolis in early August, months earlier than planned, because of poor ticket sales. That news came just two days after the airline had announced new flights to Tampa and Phoenix over the winter months.

Nick Cusick, who resigned from the Airport Authority Board in July after serving more than 10 years, confirmed to the Lincoln Journal Star on Wednesday that Red Way had already burned through most of a $3 million incentive fund provided through ARPA dollars.

It used more than $900,000 in the first month and it withdrew even more in the second month, Cusick said.

For the full story, see:

(Note: ellipses, and bracketed date, added.)

(Note: the online version of the story was updated Sept. 30, 2023, and has the title “Lincoln’s Red Way ceasing operations less than 3 months after inaugural flight.”)

Towns Flourish When Entrepreneurs Want to Live in Them

(p. B1) SIDNEY, Neb. — The forest green roof and pair of bronze stags frozen in combat are impossible to miss as you drive down Interstate 80.

. . .

For 54 years, Cabela’s made its home here, a juggernaut that kept the town humming. But in 2017, the sporting goods store sold for $5 billion to Bass Pro Shops — a takeover that eventually made 2,000 jobs vanish in a town of roughly 6,600 residents.

. . .

But Sidney’s staying power still surprises experts, who say it’s driven by two factors.

One: Former Cabela’s employees opening their small businesses, diversifying the economy in a formerly one-company town.

Two: A recent influx of new (p. B3) residents, both retirees and remote workers.

. . .

Each spring, high schoolers from Nebraska and neighboring states flock to Sidney searching for the perfect prom dress. Their destination: Charlotte & Emerson, a downtown boutique — and one example of Sidney’s rebirth from the ashes of Cabela’s.

Co-owner Sarah Kaiser and husband Kurt Kaiser both worked at Cabela’s. When the company was swallowed by Missouri-based Bass Pro, the family relocated there as Sarah Kaiser ran the combined company’s human resources.

But in 2020, they decided to return to Sidney, her hometown. Sarah Kaiser opened Charlotte & Emerson with her sister. Her husband launched an online fitness store, Frost Giant Fitness. They’re two of many Sidney-based companies run by ex-Cabela’s employees who decided to stick around and start something new.

“The corporate experience of these young folks really was key to this particular recovery,” said David Iaquinta, a Nebraska Wesleyan University sociology professor who has researched Sidney’s economic development. “. . . they combined that talent with a strong desire for the lifestyle that they had. They said, ‘We’re here. We’re rooted here.’”

Budding companies are being boosted by E3, a Nebraska Community Foundation program meant to aid entrepreneurship in rural Nebraska.

Already, new businesses have remodeled once-dilapidated buildings, said Sarah Sinnett, the program’s community lead.

. . .

Economic development in Nebraska “used to be about cheap land, cheap labor and cheap incentives” to nab big companies, Stinnett said.

Now: “If you want small towns to start thriving … really it needs to be focused on entrepreneurship,” she said.

For the full story, see:

(Note: ellipses between paragraphs, and bracketed date, added; ellipsis internal to paragraph, in original.)

(Note: the online version of the story was updated April 28, 2023, and has the title “Six years after ‘Cabela’s debacle,’ Sidney’s lights are still on.”)

Lives Lost to Covid-19 Due to Slow Regulatory Recommendations

(p. B1) In the early days of the COVID-19 pandemic, the Nebraska Medical Center was at the forefront of an international clinical trial of the drug remdesivir, . . .

. . .

By April 2020, the early trial showed that remdesivir shortened the time it took for all patients hospitalized for COVID-19 to recover by five days overall, compared with those who received a placebo.

. . .

A study published last week in the British medical journal The Lancet Respiratory Medicine confirmed findings of the initial NIH trial.

Dr. Andre Kalil, who led the Omaha-based arm of the trial, said it’s always important to see studies replicated by other (p. B2) researchers.

But Kalil, in an invited commentary on the Lancet study, noted that a number of public health and medical bodies delayed acting on the early beneficial results and recommending the drug in guidelines for clinicians.

The National Institutes of Health and the Infectious Diseases Society of America guidelines for nearly two years recommended remdesivir only for hospitalized patients who received supplemental oxygen. Only after that time did the groups recommend it for patients who were hospitalized but did not need supplemental oxygen.

The World Health Organization didn’t recommend remdesivir for patients hospitalized with COVID-19 until late 2022.

“Regrettably, the delays in recommendation of remdesivir for patients — even after the initial remdesivir shortage was resolved — adversely shaped antimicrobial policy in hospitals around the world, preventing patients from receiving timely remdesivir,” wrote Kalil, a University of Nebraska Medical Center professor and an infectious diseases physician with Nebraska Medicine, the health system that includes the Nebraska Medical Center.

In an interview, Kalil said he believes more lives could have been saved if the guideline panels had been more timely in making their recommendations. All three now recommend remdesivir for hospitalized patients.

For the full story, see:

(Note: ellipses added.)

(Note: the online version of the story has the same date as the print version, and has the title “Could earlier adoption of remdesivir have saved lives during the COVID pandemic?”)

A Plant Entrepreneur Saw a Use for the Unused

(p. B1) In the summer of 1978, Allen Wilke slammed the brakes.

He did this often. A true plantsman, he observed everything but the road itself. He would spy a flowering prickly pear in the ditch, a wild grapevine. He would double back without warning, often sending his son and daughter — half-asleep in his gutted cargo van’s backseat — tumbling forward with their luggage.

This time, the plantsman was alone. He was puttering through the Sandhills on Nebraska Highway 91, a mile (p. B2) west of Taylor, when a tall, skinny evergreen — like an Italian Cypress, he thought — punctured his periphery. He slammed the brakes. He doubled back. And like he had so many times before, the owner of the Wilke Landscape Center in Columbus knocked on a stranger’s door.

“Would you mind?”

Rancher Marlin Britton led the plantsman to that eastern redcedar on the hill, rising like a steeple behind snot-nosed cattle. To Britton, the tree wasn’t remarkable. But to Wilke, scrambling up the bank for a closer look, it was a perfect fit for Nebraska’s landscaping industry. He took a few 10-inch cuttings, shook Britton’s hand and hit the road.

By the early 1980s, Wilke began retailing this new type of tree he called the “Taylor Juniper,” a play on both its origins and its naturally tailored appearance.

. . .

. . ., the Taylor Juniper is ubiquitous across Nebraska, from the town square in Taylor to the capitol grounds in Lincoln; from The Gardens at Yanney Park in Kearney to the track at Hastings College. They fill the nurseries come spring and sell out come fall — each a perfect clone of that single mother tree in Britton’s pasture.

For the full story, see:

(Note: ellipses added.)

(Note: the online version of the story was updated Nov. 15, 2022, and has the title “Taylor Junipers stand tall across Nebraska.”)

NU President Carter May Earn $1.5 Million Per Year by 2023

(p. B1) LINCOLN — The University of Nebraska Board of Regents extended President Ted Carter’s contract by three years on Thursday, potentially keeping the university’s top leader in Nebraska through 2027.

Carter’s new contract, approved unanimously, also raises his base salary by 3% this year and adds a second deferred compensation package to incentivize the president to stay at NU.

In all, Carter’s total compensation could top $1.5 million beginning in 2023.

. . .

Regents also awarded Carter, a former superintendent of the U.S. Naval Academy, a $105,000 performance bonus for the (p. B1) 2021-22 academic year.

That amount is less than the $140,000 he was eligible to receive; Carter hit 89% of the benchmarks set for him by the board last year after first- to second-year retention numbers fell at several NU campuses.

For the full story, see:

(Note: the online version of the story was updated Sept. 18, 2022, and has the title “Regents approve contract extension, pay raise for NU president.”)