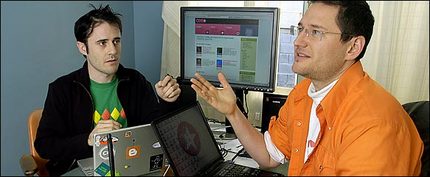

Evan Williams (on left) with Noah Glass, co-founded Odeo. Source of photo: http://www.nytimes.com/2005/02/25/technology/25podcast.html?ex=1267419600&en=b80f1d3808f556cc&ei=5088

Evan Williams (on left) with Noah Glass, co-founded Odeo. Source of photo: http://www.nytimes.com/2005/02/25/technology/25podcast.html?ex=1267419600&en=b80f1d3808f556cc&ei=5088

Evan Williams’ story illustrates Christensen and Raynor’s advice that disruptive innovators need to seek good money, and spurn bad money. Good money is patient for growth, but impatient for profit. Bad money is the opposite.

EVAN WILLIAMS recently bought his freedom. It cost him a bit more than $2 million, and he says it was worth every penny.

I’m not talking about paying off a big debt to one of Tony Soprano’s loan-shark underlings. Mr. Williams is a serial entrepreneur, one of those Silicon Valley characters who start company after company. And he purchased his freedom from the venture capitalists and others who financed his company, Odeo. Mr. Williams dug into his pockets and gave them back their money. He got to keep his struggling podcast company and renamed it the Obvious Corporation.

In the process, Mr. Williams, who is 34, has become something of a cause célèbre among a small group of mostly young entrepreneurs who seem determined to turn their back on venture capitalists. They say they yearn for a new entrepreneurship model. They talk about building ”sustainable companies” suggesting something idealistic in their quest. With comments on blogs urging Mr. Williams to ”keep up the goodness,” it feels a bit like the birth of a mini-movement in the Valley.

. . .

In candid posts on his blog, Mr. Williams chronicled Odeo’s story, warts and all. He admitted to making mistakes. Getting too much venture money too early was one of them. It made it harder to persuade the board and the company’s 14 employees to change course when, for example, Apple Computer introduced a competing product that cut into Odeo’s prospects. ”It’s a bigger ship to turn,” Mr. Williams said.

For the full story, see:

(Note: ellipsis added.)

The reference for the Christensen and Raynor book is:

Christensen, Clayton M., and Michael E. Raynor. The Innovator’s Solution: Creating and Sustaining Successful Growth. Boston, MA: Harvard Business School Press, 2003.