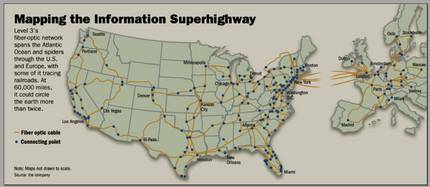

The fiber optic network of Level 3, originally founded in Omaha, Nebraska. Source of map: online version of the WSJ article cited below.

The fiber optic network of Level 3, originally founded in Omaha, Nebraska. Source of map: online version of the WSJ article cited below.

Ex ante, Level 3 seemed to have a plausible business model. When they laid fiber optics, they left room to install more, when demand, or a change in technology, made that profitable. But demand did not rise as expected; and technologists elsewhere found clever ways to cram more bandwidth into existing fiber optics. So, alas for many in Omaha, ex post, the results are in the graph below.

Fiber-optic network operator Level 3 Communications Inc., a high-flyer during the telecommunications bubble, almost went bankrupt after the sector burst in 2000.

Now, it is back, with a stock price that has almost doubled in the past year and bond prices that have risen about 20%.

Behind the gains: Explosive growth in video viewing over the Internet, which requires high-speed networks of the sort Level 3 offers. At the same time, a hearty appetite by investors for risky debt has enabled the company to put itself on firmer footing by refinancing its debt at lower rates. There also are good reasons to believe that Level 3 might be an acquisition candidate, though many feel such speculation is overblown.

But there are reasons to be wary: The company remains saddled with debt, it is in a business that still has excess capacity, and it has reported a quarterly profit just once in its more than 20-year history. With the stock and bonds at lofty levels, it could be that any future possible good news already is priced in.

For the full story, see:

(Note: the above version is the online version, and differs some from the print version, though not in substance, as far as I noticed.)

Level 3 stock prices. Source of graphic: online version of the WSJ article cited below.

Level 3 stock prices. Source of graphic: online version of the WSJ article cited below.