In Portland, the government is stopping an 11 year old girl from selling mistletoe to raise money for her braces. Here is a link to the KATU local Portland ABC news station video report: http://www.katu.com/news/local/11-year-old-told-not-to-sell-mistletoe-but-begging-is-fine-234014261.html?tab=video&c=y It also has been posted to YouTube at: http://www.youtube.com/watch?v=Vj4caXi0wdw

Use of Floppy Disks Shows Slowness of Government

(p. A14) WASHINGTON — The technology troubles that plagued the HealthCare.gov website rollout may not have come as a shock to people who work for certain agencies of the government — especially those who still use floppy disks, the cutting-edge technology of the 1980s.

Every day, The Federal Register, the daily journal of the United States government, publishes on its website and in a thick booklet around 100 executive orders, proclamations, proposed rule changes and other government notices that federal agencies are mandated to submit for public inspection.

So far, so good.

It turns out, however, that the Federal Register employees who take in the information for publication from across the government still receive some of it on the 3.5-inch plastic storage squares that have become all but obsolete in the United States.

. . .

“You’ve got this antiquated system that still works but is not nearly as efficient as it could be,” said Stan Soloway, chief executive of the Professional Services Council, which represents more than 370 government contractors. “Companies that work with the government, whether longstanding or newcomers, are all hamstrung by the same limitations.”

The use of floppy disks peaked in American homes and offices in the mid-1990s, and modern computers do not even accommodate them anymore. But The Federal Register continues to accept them, in part because legal and security requirements have yet to be updated, but mostly because the wheels of government grind ever slowly.

. . .

. . . , experts say that an administration that prided itself on its technological savvy has a long way to go in updating the computer technology of the federal government. HealthCare.gov and the floppy disks of The Federal Register, they say, are but two recent examples of a government years behind the private sector in digital innovation.

For the full story, see:

JADA F. SMITH. “Slowly They Modernize: A Federal Agency That Still Uses Floppy Disks.” The New York Times (Sat., December 7, 2013): A14.

(Note: ellipses added.)

(Note: the online version of the article has the date December 6, 2013.)

Carnegie Was Important Innovative Entrepreneur

Source of book cover image: http://img1.imagesbn.com/p/9781594201042_p0_v2_s260x420.JPG

Andrew Carnegie was a famous, much reviled, and much praised innovative entrepreneur. He is not my favorite innovative entrepreneur. He was happy to have the government protect the steel industry, and he tried to have his sidekick take all the blame for a violent episode at his steel works. But he worked hard (at least in his early decades), was often generous, fought against Teddy Roosevelt’s imperialism, and most importantly, he greatly improved the process for making steel, thereby increasing its quality and decreasing its price.

Nasaw’s serious and substantial biography is useful at untangling and documenting the good and the bad. In the next several weeks, I will be quoting some of the more important or thought-provoking passages in the book.

Nasaw’s biography of Carnegie is:

Nasaw, David. Andrew Carnegie. New York: Penguin Press, 2006.

(Note: the pagination of the hardback and paperback editions of Nasaw’s book are the same.)

Functional Stupidity Management

(p. 1194) In this paper we question the one-sided thesis that contemporary organizations rely on the mobilization of cognitive capacities. We suggest that severe restrictions on these capacities in the form of what we call functional stupidity are an equally important if under-recognized part of organizational life. Functional stupidity refers to an absence of reflexivity, a refusal to use intellectual capacities in other than myopic ways, and avoidance of justifications. We argue that functional stupidity is prevalent in contexts dominated by economy in persuasion which emphasizes image and symbolic manipulation. This gives rise to forms of stupidity management that repress or marginalize doubt and block communicative action. In turn, this structures individuals’ internal conversations in ways that emphasize positive and coherent narratives and marginalize more negative or ambiguous ones. This can have productive outcomes such as providing a degree of certainty for individuals and organizations. But it can have corrosive consequences such as creating a sense of dissonance among individuals and the organization as a whole. The positive consequences can give rise to self-reinforcing stupidity. The negative consequences can spark dialogue, which may undermine functional stupidity.

Source of paper abstract:

Alvesson, Mats, and André Spicer. “A Stupidity-Based Theory of Organizations.” Journal of Management Studies 49, no. 7 (Nov. 2012): 1194-220.

Innovative Fracking Entrepreneurs Again Show that Energy Is Only Limited by Ingenuity

Source of book image: online version of the NYT review quoted and cited below.

(p. 7) In “The Frackers,” Gregory Zuckerman sets out a 25-year narrative that focuses on the half-dozen or so Texas and Oklahoma energy companies behind the fracking boom, especially Chesapeake Energy, the Oklahoma City giant that is the Exxon Mobil of fracking. Technologies are born. Gushers gush. And fortunes are made and lost.

In the process, Mr. Zuckerman assembles a chorus of little-heard American voices, from George Mitchell, the Greek goatherd’s son whose company first perfected fracking, to Chesapeake’s two founders, Aubrey K. McClendon and Tom L. Ward.

. . .

Geologists knew that layers of shale spread across North America contained commercial amounts of oil and gas, but not until a young geologist at Mr. Mitchell’s company, Mitchell Energy, perfected a new “secret sauce” of water-based fracturing liquids in the early 1990s did layers of shale — in Mitchell’s case, the Barnett Shale of North Texas — melt away and begin to yield jaw-dropping gushers.

Oryx Energy, a company that was based in Dallas, was among the first to pair fracking with horizontal drilling, producing even more startling results. Still, it took years, Mr. Zuckerman writes, before larger businesses, especially the skeptical major oil companies, fathomed what their smaller rivals had achieved. This allowed what were flyspeck outfits like Chesapeake to lease vast acreage in shale-rich areas, from Montana to eastern Pennsylvania.

For the full review, see:

BRYAN BURROUGH. “OFF THE SHELF; The Birth of an Energy Boom.” The New York Times, SundayBusiness Section (Sun., November 2, 2013): 7.

(Note: ellipses added.)

(Note: the online version of the review has the date November 2, 2013, and has the title “OFF THE SHELF; ‘The Frackers’ and the Birth of an Energy Boom.”)

Book being reviewed:

Zuckerman, Gregory. The Frackers: The Outrageous inside Story of the New Billionaire Wildcatters. New York: Portfolio/Penguin, 2013.

Interruptions and Distractions Disrupt Worker Productivity

Someday we will look back at open office plans as another way-overdone management fad. See also my earlier entry on the effects of workers switching tasks and my earlier entry on open offices.

(p. D2) Research led by Bing C. Lin, a doctoral candidate in industrial and organizational psychology at Portland State University in Oregon, found intrusions, or unexpected interruptions, increased exhaustion, physical strain and anxiety by one-third to three-fourths as much as the size of employees’ actual workloads. Bottling up frustration when someone barges into your cubicle worsens the strain, according to the study of 252 employees, published earlier this year in the International Journal of Stress Management.

For the full story, see:

SUE SHELLENBARGER. “WORK & FAMILY MAILBOX; Sue Shellenbarger Answers Readers’ Questions.” The Wall Street Journal (Weds., Nov. 13, 2013): D2.

(Note: the online version of the review has the date Nov. 12, 2013, and has the title “WORK & FAMILY; The Toll of Office Disruptions; Latest Research on Distractions and Worker Efficiency.”)

The Lin study summarized above is:

Lin, Bing C., Jason M. Kain, and Charlotte Fritz. “Don’t Interrupt Me! An Examination of the Relationship between Intrusions at Work and Employee Strain.” International Journal of Stress Management 20, no. 2 (2013): 77-94.

Wind Power Increases Government Corruption

“Kathy Laclair of Churubusco, N.Y., dislikes the noise from the wind turbine blades and says their shadows give her vertigo.” Source of caption and photo: online version of the NYT article quoted and cited below.

“Kathy Laclair of Churubusco, N.Y., dislikes the noise from the wind turbine blades and says their shadows give her vertigo.” Source of caption and photo: online version of the NYT article quoted and cited below.

(p. A1) Lured by state subsidies and buoyed by high oil prices, the wind industry has arrived in force in upstate New York, promising to bring jobs, tax revenue and cutting-edge energy to the long-struggling region. But in town after town, some residents say, the companies have delivered something else: an epidemic of corruption and intimidation, as they rush to acquire enough land to make the wind farms a reality.

“It really is renewable energy gone wrong,” said the Franklin County district attorney, Derek P. Champagne, who began a criminal inquiry into the Burke Town Board last spring and was quickly inundated with complaints from all over the state about the (p. A16) wind companies.

. . .

. . . corruption is a major concern. In at least 12 counties, Mr. Champagne said, evidence has surfaced about possible conflicts of interest or improper influence.

In Prattsburgh, N.Y., a Finger Lakes community, the town supervisor cast the deciding vote allowing private land to be condemned to make way for a wind farm there, even after acknowledging that he had accepted real estate commissions on at least one land deal involving the farm’s developer.

A town official in Bellmont, near Burke, took a job with a wind company after helping shepherd through a zoning law to permit and regulate the towers, according to local residents. And in Brandon, N.Y., nearby, the town supervisor told Mr. Champagne that after a meeting during which he proposed a moratorium on wind towers, he had been invited to pick up a gift from the back seat of a wind company representative’s car.

When the supervisor, Michael R. Lawrence, looked inside, according to his complaint to Mr. Champagne, he saw two company polo shirts and a leather pouch that he suspected contained cash.

When Mr. Lawrence asked whether the pouch was part of the gift, the representative replied, “That’s up to you,” according to the complaint.

For the full story, see:

NICHOLAS CONFESSORE. “In Rural New York, Windmills Can Bring Whiff of Corruption.” The New York Times (Mon., August 18, 2008): A1 & A16.

(Note: ellipses added.)

(Note: the online version of the article has the date August 17, 2008.)

“To some upstate towns, wind power promises prosperity. Others fear noise, spoiled views and the corrupting of local officials.” Source of caption and photo: online version of the NYT article quoted and cited above.

“Israel’s Entrepreneurial Character”

(p. 272) Israel’s entrepreneurial character led Google to establish a center in Haifa as well as the more expected Tel Aviv. The Haifa office was a move to accommodate Yoelle Maarek, a celebrated computer scientist who had headed IBM’s labs in Israel. Google hired another world-class computer scientist, Yossi Matias, to head the Tel Aviv office. (In 2009, during Google’s austerity push, the company would merge the engineering centers and Maarek would depart.)

Source:

Levy, Steven. In the Plex: How Google Thinks, Works, and Shapes Our Lives. New York: Simon & Schuster, 2011.

Amazon’s Story of the Evolution and Revolution of Disruptive Innovation

Source of book image:

http://i1.wp.com/allthingsd.com/files/2013/10/Stone_EverythingStore1.jpg

(p. C5) Mr. Stone, a senior writer for Bloomberg Businessweek and a former reporter for The New York Times, tells this story of disruptive innovation with authority and verve, and lots of well-informed reporting. Although “The Everything Store” retraces early ground covered by Robert Spector’s 2000 book, “Amazon.com: Get Big Fast,” Mr. Stone has conducted more than 300 interviews with current and former Amazon executives and employees, including conversations, over the years, with Mr. Bezos, who “in the end was supportive of this project even though he judged that it was ‘too early’ for a reflective look” at the company.

“The Everything Store” does not examine in detail the fallout that Amazon’s rise has had on book publishing and on independent bookstores, but Mr. Stone does a nimble job of situating the company’s evolution within the wider retail landscape and within the technological revolution that was remaking the world at the turn of the millennium.

For the full review, see:

MICHIKO KAKUTANI. “BOOKS OF THE TIMES; Selling as Hard as He Can.” The New York Times (Tues., October 29, 2013.): C1 & C5.

(Note: the online version of the review has the date October 28, 2013.)

The book under review is:

Stone, Brad. The Everything Store: Jeff Bezos and the Age of Amazon. New York: Little, Brown and Company, 2013.

“Brad Stone” Source of caption and photo: online version of the NYT review quoted and cited above.

Paper Towels Are Better than Air Dryers at Removing Bacteria

Green environmentalists have forced hot air hand dryers on us in many public restrooms. They are slow and noisy and frustrating, and many of us leave the restroom with still-wet hands. But did you also know that by taking away our paper towels, the environmentalists are helping to spread disease? Read the article abstract below:

(p. 791) The transmission of bacteria is more likely to occur from wet skin than from dry skin; therefore, the proper drying of hands after washing should be an integral part of the hand hygiene process in health care. This article systematically reviews the research on the hygienic efficacy of different hand-drying methods. A literature search was conducted in April 2011 using the electronic databases PubMed, Scopus, and Web of Science. Search terms used were hand dryer and hand drying. The search was limited to articles published in English from January 1970 through March 2011. Twelve studies were included in the review. Hand-drying effectiveness includes the speed of drying, degree of dryness, effective removal of bacteria, and prevention of cross-contamination. This review found little agreement regarding the relative effectiveness of electric air dryers. However, most studies suggest that paper towels can dry hands efficiently, remove bacteria effectively, and cause less contamination of the washroom environment. From a hygiene viewpoint, paper towels are superior to electric air dryers. Paper towels should be recommended in locations where hygiene is paramount, such as hospitals and clinics.

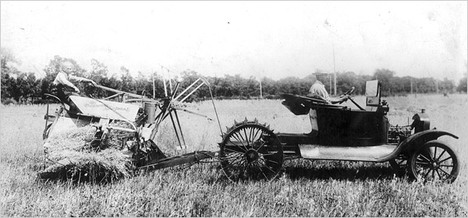

Kits Let Model T Owners Transform Them into Tractors, Snowmobiles, Roadsters and Trucks

“OFF ROAD; Kits to take the Model T places Henry Ford never intended included tractor conversions, . . . ” Source of caption and photo: online version of the NYT article quoted and cited below.

“OFF ROAD; Kits to take the Model T places Henry Ford never intended included tractor conversions, . . . ” Source of caption and photo: online version of the NYT article quoted and cited below.

(p. 1) WHEN Henry Ford started to manufacture his groundbreaking Model T on Sept. 27, 1908, he probably never imagined that the spindly little car would remain in production for 19 years. Nor could Ford have foreseen that his company would eventually build more than 15 million Tin Lizzies, making him a billionaire while putting the world on wheels.

But nearly as significant as the Model T’s ubiquity was its knack for performing tasks far beyond basic transportation. As quickly as customers left the dealers’ lot, they began transforming their Ts to suit their specialized needs, assisted by scores of new companies that sprang up to cater exclusively to the world’s most popular car.

Following the Model T’s skyrocketing success came mail-order catalogs and magazine advertisements filled with parts and kits to turn the humble Fords into farm tractors, mobile sawmills, snowmobiles, racy roadsters and even semi-trucks. Indeed, historians credit the Model T — which Ford first advertised as The Universal Car — with launching today’s multibillion-dollar automotive aftermarket industry.

For the full story, see:

LINDSAY BROOKE. “Mr. Ford’s T: Mobility With Versatility.” The New York Times, Automobiles Section (Sun., July 20, 2008): 1 & 14.

(Note: the online version of the story has the title “Mr. Ford’s T: Versatile Mobility.”)