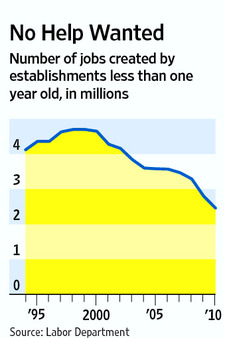

Source of graph: online version of the WSJ article quoted and cited below.

(p. B1) Start-ups fuel job growth disproportionately since by definition they are starting and growing, adding employees, says the Kauffman Foundation, which researches and advocates for entrepreneurship.

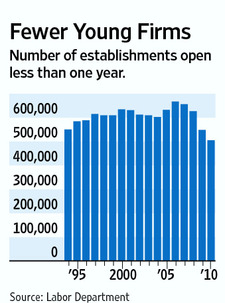

Though there was start-up activity during and after the recession, driven partly by unemployed individuals putting out a shingle, Bureau of Labor Statistics data show the total number of “births” of new businesses declined sharply from previous years. What’s more, the number of people employed by new businesses that are less than a year old–a common definition of a start-up–also declined. That trend started a decade ago.

In a recent report on entrepreneurship, the BLS said the number of new businesses less than a year old that existed in the year ending March 2010 “was lower than any other year” since its research began in 1994. The downdraft started with the recession.

“More people who were self-employed failed and left self-employment than people who entered,” says Scott Shane, an economics professor at Case Western Reserve University who wrote a study on entrepreneurship and the recession for the Cleveland Fed. “The net effect is negative, not positive, largely because downturns hurt those in business and those thinking of entering business.”

For the full story, see:

JOHN BUSSEY. “THE BUSINESS; Shrinking in a Bad Economy: America’s Entrepreneur Class.” The Wall Street Journal (Fri., AUGUST 12, 2011): B1 & B2.

(Note: ellipsis added.)

The BLS report mentioned above can be found at: http://www.bls.gov/bdm/entrepreneurship/entrepreneurship.htm

The Scott Shane commentary mentioned above can be found at:

http://www.clevelandfed.org/research/commentary/2011/2011-04.cfm

Source of graph: online version of the WSJ article quoted and cited above.