Source of book image: online version of the WSJ review quoted and cited below.

I think the crucial feature of Wikipedia is in its being quick (what “wiki” means in Hawaiian), rather than in its current open source model. Academic knowledge arises in a slow, vetted process. Publication depends on refereeing and revision. On Wikipedia (and the web more generally) knowledge is posted first, and corrected later.

In the actual fact, Wikipedia’s coverage is vast, and its accuracy is high.

I speculate that Wikipedia provides clues to developing new, faster, more efficient knowledge generating institutions.

(Chris Anderson has a nice discussion of Wikipedia in The Long Tail, starting on p. 65.)

(p. A13) Until just a couple of years ago, the largest reference work ever published was something called the Yongle Encyclopedia. A vast project consisting of thousands of volumes, it brought together the knowledge of some 2,000 scholars and was published, in China, in 1408. Roughly 600 years later, Wikipedia surpassed its size and scope with fewer than 25 employees and no official editor.

In “The Wikipedia Revolution,” Andrew Lih, a new-media academic and former Wikipedia insider, tells the story of how a free, Web-based encyclopedia — edited by its user base and overseen by a small group of dedicated volunteers — came to be so large and so popular, to the point of overshadowing the Encyclopedia Britannica and many other classic reference works. As Mr. Lih makes clear, it wasn’t Wikipedia that finished off print encyclopedias; it was the proliferation of the personal computer itself.

. . .

By 2000, both Britannica and Microsoft had subscription-based online encyclopedias. But by then Jimmy Wales, a former options trader in Chicago, was already at work on what he called “Nupedia” — an “open source, collaborative encyclopedia, using volunteers on the Internet.” Mr. Wales hoped that his project, without subscribers, would generate its revenue by selling advertising. Nupedia was not an immediate success. What turned it around was its conversion from a conventionally edited document into a wiki (Hawaiian for “fast”) — that is, a site that allowed anyone browsing it to edit its pages or contribute to its content. Wikipedia was born.

The site grew quickly. By 2003, according to Mr. Lih, “the English edition had more than 100,000 articles, putting it on par with commercial online encyclopedias. It was clear Wikipedia had joined the big leagues.” Plans to sell advertising, though, fell through: The user community — Wikipedia’s core constituency — objected to the whole idea of the site being used for commercial purposes. Thus Wikipedia came to be run as a not-for-profit foundation, funded through donations.

. . .

It is clear by the end of “The Wikipedia Revolution” that the site, for all its faults, stands as an extraordinary demonstration of the power of the open-source content model and of the supremacy of search traffic. Mr. Lih observes that when “dominant encyclopedias” were still hiding behind “paid fire walls” — and some still are — Wikipedia was freely available and thus easily crawled by search engines. Not surprisingly, more than half of Wikipedia’s traffic comes from Google.

For the full review, see:

JEREMY PHILIPS. “Business Bookshelf; Everybody Knows Everything.” Wall Street Journal (Weds., March 18, 2009): A13.

(Note: ellipses added.)

The book being reviewed, is:

Lih, Andrew. The Wikipedia Revolution: How a Bunch of Nobodies Created the World’s Greatest Encyclopedia. New York: Hyperion, 2009.

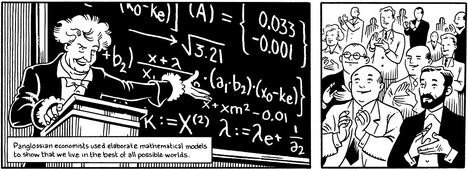

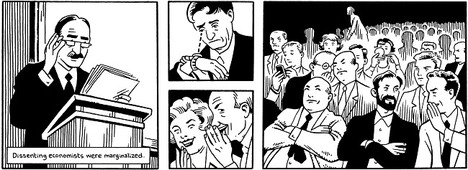

Source of caricatures: online version of the NYT article quoted and cited below.

Source of caricatures: online version of the NYT article quoted and cited below. The economist on the left is probably intended to resemble Keynes, but he also bears some resemblance to Hayek. Source of caricatures: online version of the NYT article quoted and cited above.

The economist on the left is probably intended to resemble Keynes, but he also bears some resemblance to Hayek. Source of caricatures: online version of the NYT article quoted and cited above.