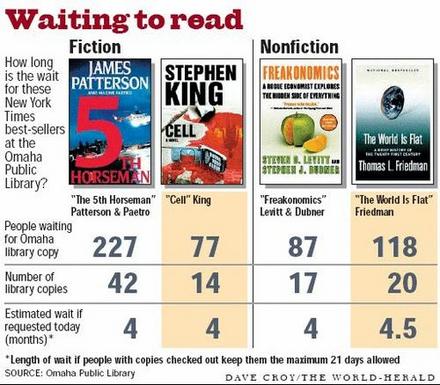

Source of the graphic is page 1 of: MICHAEL O’CONNOR. “Library may help turn borrowers into buyers.” Omaha World-Herald (Saturday, March 4, 2006): 1 & 2.

If you live in Omaha, and want to check out a copy of Thomas Friedman’s pro-trade and globalization best-seller The World is Flat, it looks as though you’re going to have to wait awhile. While you’re waiting, you may want to read his earlier, and in some ways better, The Lexus and the Olive Tree. It is better in its discussion of the importance of Schumpeterian creative destruction, and better in terms of the coherence and flow of the argument.

See:

Friedman, Thomas L. The Lexus and the Olive Tree. New York: Anchor Books, 2000. [ISBN # 0-385-49934-5]

Friedman, Thomas L. The World Is Flat: A Brief History of the Twenty-First Century. New York: Farrar, Straus and Giroux, 2005.

Category: Schumpeter

Lazear, New Chair of Council of Economic Advisors, Emphasizes Labor Market Flexibility

Ed Lazear was a labor economist at the University of Chicago during the time that I was a graduate student there, circa 1975-81. Sometimes in collaboration with the late Sherwin Rosen, he created models of the labor market that suggest ways of understanding otherwise puzzling labor market phenomena, for example in suggesting that CEOs might be highly paid to provide an incentive for all those who participate in the ‘rank-order tournament’ that results in the choice of CEO (see the Lazear-Rosen paper cited below).

Here is a brief excerpt from remarks by Ed Lazear following his being sworn in as Chair of the President’s Council of Economic Advisors on 3/6/06:

Healthy productivity growth over the past few years has been followed by impressive job creation and reductions in unemployment rates to levels that are low by historical standards. And we continue to improve. Much of the strength of the U.S. economy results from flexibility in labor and capital markets, and from keeping tax rates low.

For the full remarks, see: http://www.whitehouse.gov/news/releases/2006/03/20060306.html (Thanks to Gary Blank for providing me this link.)

One of Lazear’s most interesting papers:

Lazear, Edward, and Sherwin Rosen. “Rank-Order Tournaments as Optimum Labor Contracts.” Journal of Political Economy 89, no. 5 (1981): 841-864.

EU Legislation to Protect the Incompetent

The source for the book cover image is: Amazon.com.

The brief book description on Amazon. com:

Bad is the new good. In the not too distant future the European Union enacts its most far reaching human rights legislation ever. The incompetent have been persecuted for too long. After all it’s not their fault they can’t do it right, is it? So it is made illegal to sack or otherwise discriminate against anyone for being incompetent. And now a murder has been committed and our possibly incompetent detective must find out who the murderer is. As long as he can find directions to get him through the mean streets.

Rob Grant. Incompetence. Orion Pub Co., 2003. ISBN: 0575074191

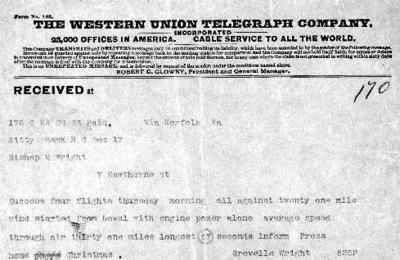

Notice of End of Telegram Service, Posted to Western Union Web Site

A telegram. Source of image: online version of article cited below.

BLOOMBERG NEWS

After 155 years in the telegraph business, Western Union has cabled its final dispatch.

The service that in the mid-1800s displaced pony-borne messengers has itself been supplanted over the last half-century by cheap long-distance telephone service, faxes and e-mail.

In a final bit of irony, Western Union informed customers last week in a message on its Web site.

For the full story, see the online version of:

“First Data Unit Scraps Telegrams.” Omaha World-Herald (Thurs., February 2, 2006): 9D.

(In the online version, the headline reads: “Western Union Telegrams Are No More.”)

Solow’s Wit (But Not Wisdom): Treat Schumpeter “Like a Patron Saint”

(p. 195) As Robert Solow wrote acidly in 1994, commenting on a series of papes on growth and imperfect competition, “Schumpeter is a sort of patron saint in this field. I may be alone in thinking that he should be treated like a patron saint: paraded around one day each year and more or less ignored the rest of the time.”

Schumpeter was a most unwelcome guest at the neoclassical table. Yet it was hard for the mainstream to reject him out of hand, since Schumpeter was such a celebrant of capitalism and entrepreneurship. He thought it a superb, energetic, turbulent system, one that led to material betterment over time. He hoped it would triumph over socialism. He just didn’t believe it functioned in anything close to the way the Marshallians did, and he was appalled that economists could apply an essentially static model to something as profoundly dynamic as capitalism. Schumpeter wrote presciently, “Whereas a stationary feudal economy would still be a feudal economy, and a stationary socialist economy would still be a socialist economy, stationary capitalism is a contradiction in terms.” Its very essence, as the economic historian Nathan Rosenberg wrote, (p. 196) echoing Schumpeter, “lies not in equilibrating forces, but in the inevitable tendency to depart from equilibrium” every time an innovation occurs.

Source:

Kuttner, Robert. Everything for Sale: The Virtues and Limits of Markets. Chicago: University of Chicago Press, 1999.

“I would have fired me if I was him”

Warren Buffett. Source of image: online version of WSJ article cited below.

A couple of years ago, I think, in the mid-afternoon we went into a nearly deserted Dairy Queen near Dodge and 115th and walked by an old guy eating ice cream with a couple of others (I’m guessing his daughter and grandchild). I said to Jeanette and Jenny something like: if that guy wasn’t dressed so weirdly, I’d say he might be Warren Buffett. He was wearing some kind of overalls with the word WOODS printed in capitals on the back. Suddenly I remembered that I had seen in the paper that Buffett had caddied for Tiger Woods in some sort of celebrity tournament a few weeks earlier. We were tempted to ask for his autograph, but we let him eat his ice cream in peace.

(p. A1) He spends most of his day alone in an office with no computer. He makes swift investment decisions, steers clear of meetings and advisers, eschews set procedures and doesn’t require frequent reports from managers.

. . .

(p. A5A (sic)) Mr. Buffett tends to stick to investments for the long haul, even when the going gets bumpy. Mr. Sokol recalls bracing for an August 2004 meeting at which he planned to break the news to Mr. Buffett that the Iowa utility needed to write off about $360 million for a soured zinc project. Mr. Sokol says he was stunned by Mr. Buffett’s response: “David, we all make mistakes.” Their meeting lasted only 10 minutes.

“I would have fired me if I was him,” Mr. Sokol says.

“If you don’t make mistakes, you can’t make decisions,” Mr. Buffett says. “You can’t dwell on them.” Mr. Buffett notes that he has made “a lot bigger mistakes” himself than Mr. Sokol did.

For the full article, see:

SUSAN PULLIAM and KAREN RICHARDSON. “Warren Buffett, Unplugged; The hands-off billionaire shuns computers, leaves his managers alone, yet has notched huge returns. He just turned 75. Can anyone fill his shoes?” THE WALL STREET JOURNAL (Sat., November 12, 2005): A1 & A5A.

Source of graph: online version of WSJ article cited above.

Trickle-Down in India

BANGALORE, India, July 4 – It has been a little more than a year since the government of Prime Minister Manmohan Singh came into power promising to embrace those excluded from the country’s new economic prosperity.

While the impact of his government’s efforts to help the poor — like increasing credit to the country’s many farmers and pumping in money for infrastructure, especially in rural areas — will not show for another few years, experts say, the bounty from the expansion in manufacturing and services that has been putting money in the hands of millions of Indians is now noticeably trickling down.

”What is happening is amazing,” said Joe Paul, the founder and chairman of the Uthsaha Society, a networking group that encourages slum dwellers in Bangalore to become financially independent. ”It is a ripple effect.”

. . .

. . . , where the new prosperity is percolating, it spans a broad spectrum and reflects much more than an occasional, isolated success story. A big catalyst is the construction boom in high-tech cities like Bangalore and Madras. Besides the demand for construction workers, workers at factories supplying the building materials, and drivers to transport those products, there is a demand for housekeepers, cooks and drivers to cater to the double-income families who live in the new residential complexes and high-rises. Caterers are needed to supply food to the office workers. Security guards are also in demand. Trained nurses are needed to tend to aging parents of workers traveling overseas or living in other cities.

”The last few years of strong growth has facilitated poverty reduction, even though the fruits of growth were not distributed evenly,” said Ping Chew, a sovereign credit analyst at Standard & Poor’s in Singapore. ”The middle-income group continues to be the biggest beneficiary and this will ensure that the benefits continue to pass on to the lower-income class.”

For the full story, see:

SARITHA RAI. “In India, Economic Prosperity Is Spreading Slowly.” The New York Times (Tuesday, July 5, 2005): C3.

The Open Road

A strong argument could be made that the automobile is one of the two most liberating inventions of the past century, ranking only behind the microchip. The car allowed even the common working man total freedom of mobility — the means to go anywhere, anytime, for any reason. In many ways, the automobile is the most egalitarian invention in history, dramatically bridging the quality-of-life gap between rich and poor. The car stands for individualism; mass transit for collectivism. Philosopher Waldemar Hanasz, who grew up in communist Poland, noted in his 1999 essay “Engines of Liberty” that Soviet leaders in the 1940s showed the movie “The Grapes of Wrath” all over the country as propaganda against the evils of U.S. capitalism and the oppression of farmers. The scheme backfired because “far from being appalled, the Soviet viewers were envious; in America, it seemed, even the poorest had cars and trucks.”

. . .

The simplistic notion taught to our second-graders, that the car is an environmental doomsday machine, reveals an ignorance of history. When Henry Ford first started rolling his Black Model Ts off the assembly line at the start of the 20th century, the auto was hailed as one of the greatest environmental inventions of all time. That’s because the horse, which it replaced, was a prodigious polluter, dropping 40 pounds of waste a day. Imagine what a city like St. Louis smelled like on a steamy summer afternoon when the streets were congested with horses and piled with manure.

. . .

There’s a perfectly good reason that the roads are crammed with tens of millions of cars and that Americans drive eight billion miles a year while spurning buses, trains, bicycles and subways. Americans are rugged individualists who don’t want to cram aboard buses and subways. We want more open roads and highways, and we want energy policies that will make gas cheaper, not more expensive. We want to travel down the road from serfdom and the car is what will take us there.

For the full commentary, see:

Moore, Stephen. “Supply Side; The War Against the Car.” The Wall Street Journal (Fri., November 11, 2005): A10.

“Better Coffee Rockefeller’s Money Can’t Buy”

(p. 263) In the middle of this fierce competition, with its low quality standards and apparent market saturation, a New York nut vendor and restaurateur proved that a new brand stressing quality could triumph.

. . .

Black understood the power of advertising. In radio spots, which blanketed the New York metropolitan airwaves, Black’s second wife, Jean Martin, sang a hummable jingle:

Chock full o’ Nuts is that heavenly coffee,

Heavenly coffee, heavenly coffee.

(p. 264) Chock full o’ Nuts is that heavenly coffee-

Better coffee Rockefeller’s money can’t buy.

By August 1954, less than a year after its debut, Chock full o’ Nuts had grabbed third place among vacuum-packed coffees in New York City.

Source:

Pendergrast, Mark. Uncommon Grounds: The History of Coffee and How It Transformed Our World. New York: Basic Books, 2000.

(Note: ellipsis added.)

“Going Postal” Shows that Free Market Jobs Are Not the Only Ones with Stress

WASHINGTON (AP) – The deadly shootings at a California mail processing plant are a grim reminder of cases in the 1980s and ’90s that raised public concern and brought the post office and its employees and supervisors together in an effort to end violence at work.

Postmaster General John Potter met with union leaders Tuesday to discuss the tragedy, while Deputy Postmaster General Patrick R. Donahoe headed to the scene of the shootings.

Donahoe urged all postal employees to stay vigilant about facility security.

“That’s the best line of defense to keep ourselves safe,” he said, urging workers to make sure all doors close correctly and all locks function properly, and that only authorized people are in postal facilities.

In the California case, the shooter had taken an identification badge from a postal worker at gunpoint, postal officials said.

A 1986 case in Edmond, Okla., resulted in 14 people being killed before a disgruntled carrier took his own life. It was followed by a series of killings stretching into the 1990s that led to the rise of the phrase “going postal.”

In 1992, the post office and several of its unions and supervisors organizations signed a joint statement calling for zero tolerance of violence in the workplace, as well as banning harassment, intimidation, threats or bullying.

Some incidents were traced to disputes between workers and their managers, and in the statement the Postal Service promised that people who do not treat others with dignity or respect would not be rewarded or promoted.

For the full story, see the online version of the Omaha World-Herald:

“Postal Shooting a Grim Reminder of Past.” Omaha World-Herald (Weds., February 1, 2006).

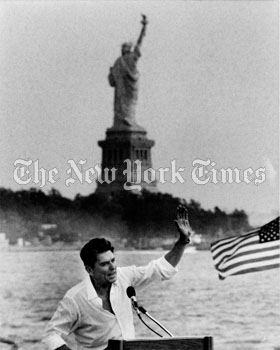

Reagan “the man who championed creative destruction”

Image source: http://www.nytstore.com/ProdDetail.aspx?prodId=2689

Image source: http://www.nytstore.com/ProdDetail.aspx?prodId=2689

From Wooldridge’s review of a book on Ronald Reagan:

Reeves argues that Reagan was a master of both imagination and delegation. He stuck firmly to a small number of clear goals – reducing the size of government, restoring America’s power and pride, and facing down Communism – and then delegated implementation to the “fellas.” He did not so much do things as persuade others to do them for him. But his preference for delegation should not be confused with passivity. He insisted on using the phrase “tear down this wall” against the advice of his underlings, for example.

Wooldridge describes Reagan as, in part:

. . . the man who championed “creative destruction” . . .

The review is:

ADRIAN WOOLDRIDGE. “The Great Delegator.” The New York Times, Section 7 (Sunday, January 29, 2006): 11.

The book being reviewed is:

Richard Reeves. PRESIDENT REAGAN: The Triumph of Imagination. Simon & Schuster, 2005, 571 pp. $30. ISBN: 0743230221