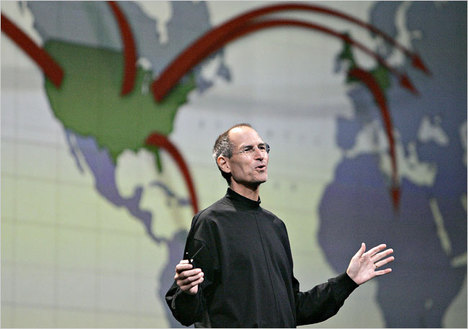

“Steven P. Jobs during a conference in June in San Francisco.” Source of caption and photo: online version of the NYT article cited below.

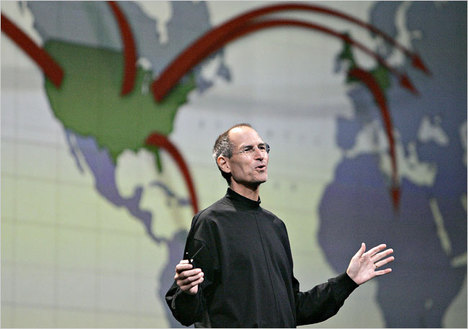

“Steven P. Jobs during a conference in June in San Francisco.” Source of caption and photo: online version of the NYT article cited below.

Sometimes Schumpeter suggested that in mature capitalism, it would be possible for some aspects of entrepreneurship to be made routine enough to be performed by corporate bureaucracies.

The creative innovations of Steve Jobs, and the stock market reaction to rumors of his ill-health, illustrate that individual entrepreneurs still matter.

(p. B2) During Apple’s earnings conference call Monday, Chief Financial Officer Peter Oppenheimer declined to answer an analyst’s question about Mr. Jobs’s health, calling it “a private matter.” Apple’s demurral raised new concerns among investors, who have been worried about Mr. Jobs’s health since a 2004 bout with pancreatic cancer.

Their fears flared earlier this year, when Mr. Jobs appeared gaunt at a public appearance; the company at the time blamed “a common bug.” The fears were stoked anew this week with a report in the New York Post that the CEO is unwell. Now, said one Apple fund investor, “everyone’s worried.”

Apple shares fell as low as $146.53 earlier Tuesday following the company’s lackluster outlook for the current quarter. Some analysts suggested that concerns about Mr. Jobs’s health were also weighing on the stock, which closed at $162.02, down $4.27, in 4 p.m. Nasdaq Stock Market trading.

. . .

The dearth of information has led investors to do their own digging over the years. In 2004, one hedge fund hired private investigators to tail Mr. Jobs to hospital appointments in the hopes of figuring out how sick he was, said a portfolio manager at the fund. Eventually, he said, Mr. Jobs “seemed to catch on,” and became harder to track.

More recently, hedge-fund managers said Tuesday, fund managers have talked of asking doctors to closely analyze pictures of Mr. Jobs to monitor changes in his physical appearance, and have been talking about once again hiring investigators to find out Mr. Jobs’s prognosis.

For the full story, see:

BEN CHARNY and JUSTIN SCHECK. “Worries Over Jobs’s Health Weighs on the Stock.” The Wall Street Journal (Weds., July 23, 2008): B2.

(Note: ellipses added.)

Another relevant WSJ article is:

breakingviews.com. “GE Deal Is Looking Bright; Abu Dhabi Capital Accord Yields Potential Benefits For Both Participants; Boardroom Health.” The Wall Street Journal (Weds., July 23, 2008): C18.

(Note: The online version of the title of this second WSJ article is: “GE’s Imagination at Work Challenged at Home, Company Strikes Gusher With Abu Dhabi Linkup.” )

The NYT article is:

JOHN MARKOFF. “Talk of Chief’s Health Weighs on Apple’s Share Price.”

The New York Times (Weds., July 23, 2008): C5.

In fairness to Schumpeter, his position on this issue was frequently conflicted, as has been shown and discussed in:

Langlois, Richard N. “Schumpeter and the Obsolescence of the Entrepreneur.” Advances in Austrian Economics 6 (2003): 287-302.