(p. B1) President Obama has cast himself as a reluctant interventionist in two of the nation’s major industries, Wall Street and Detroit. The federal aid, he says, is a financial bridge to a postcrisis future and the hand-holding will be temporary.

Even so, the scale of the government investment and control — especially by the auto task force now vetting plans at Chrysler and General Motors — points to an approach that has been shunned by the United States more than other developed nations.

“By any coherent definition, this is industrial policy,” said Marcus Noland, a senior fellow at the Peterson Institute for International Economics.

. . .

(p. B7) . . . a more comprehensive, industrial-policylike approach to Detroit carries its own perils, economists say. In trying to manage the industrial shrinkage, they say, there is a fine line between easing the social impact and protecting jobs in ways that inhibit economic change and renewal. In pursuit of new growth, governments risk encouraging overinvestment in areas that prove to be technological dead ends.

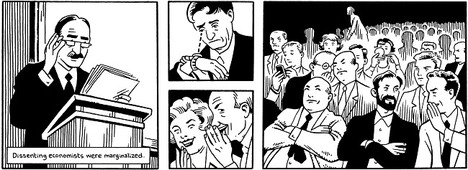

In the Japanese experience, economists see evidence of both dangers. Problems, they say, are typically byproducts of what economists call “political capture.” That is, an industrial sector earmarked for special government attention builds up its own political constituency, lobbyists and government bureaucrats to serve that industry. They slow the pace of change, and an economy becomes less nimble and efficient as a result.

Economists say the phenomenon is scarcely confined to nations with explicit industrial policies and cite the history of agricultural subsidies in America or military procurement practices.

But going down the path of industrial policy certainly holds that risk. “You have to bear in mind the opportunity costs of these kinds of government interventions, and remember that life is not an economic textbook and that politics can easily override economic rationality,” said Mr. Noland, an author, with Howard Pack, of “Industrial Policy in an Era of Globalization: Lessons From Asia.”

For the full story, see:

STEVE LOHR. “Highway to the Unknown; Forays in Industrial Policy Bring Risks.” The New York Times (Weds., May 19, 2009): B1 & B7.

(Note: the online title is “In U.S., Steps Toward Industrial Policy in Autos.”)

(Note: ellipses added.)

The full reference to Noland and Pack’s book is:

Noland, Marcus, and Howard Pack. Industrial Policy in an Era of Globalization: Lessons from Asia, Policy Analyses in International Economics. Washington, D.C.: Peterson Institute, 2003.