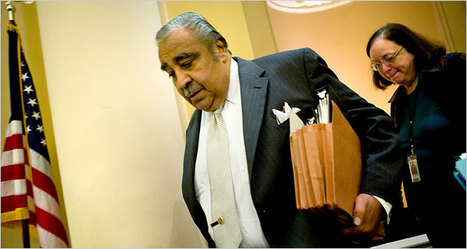

"Charles B. Rangel, House Ways and Means chairman." Source of caption and photo: online version of the NYT article quoted and cited below.

"Charles B. Rangel, House Ways and Means chairman." Source of caption and photo: online version of the NYT article quoted and cited below.

(p. A23) The chairman of the House Ways and Means Committee has proposed legislation that would effectively halt some current tax audits of people who get a tax break for living and operating a business in the United States Virgin Islands.

Many beneficiaries of the tax break are campaign contributors to the lawmaker, Representative Charles B. Rangel, Democrat of New York, according to data collected by CQ MoneyLine, which tracks political contributions.

At least one of them, Richard G. Vento, is currently under audit, according to court filings. Mr. Vento gave $4,400 last year to the Baucus-Rangel Leadership Fund, which supports Mr. Rangel and Senator Max Baucus, the Montana Democrat who heads the Senate Finance Committee.

Beneficiaries of the tax break including Michael W. Masters and Richard H. Driehaus, money managers, accounted for more than half the $51,900 that individuals in the Virgin Islands gave last year to Rangel for Congress, the chairman’s campaign organization. Mr. Rangel raised almost three times as much from such donors last year as in any other year in the MoneyLine database.

For the full story, see: