“A memorial to the famine, right, opposite a revered cathedral, was dedicated last November in Kiev. A museum is planned there.” Source of photo and caption: online version of the NYT article quoted and cited below.

“A memorial to the famine, right, opposite a revered cathedral, was dedicated last November in Kiev. A museum is planned there.” Source of photo and caption: online version of the NYT article quoted and cited below.

(p. A6) KIEV, Ukraine — A quarter century ago, a Ukrainian historian named Stanislav Kulchytsky was told by his Soviet overlords to concoct an insidious cover-up. His orders: to depict the famine that killed millions of Ukrainians in the early 1930s as unavoidable, like a natural disaster. Absolve the Communist Party of blame. Uphold the legacy of Stalin.

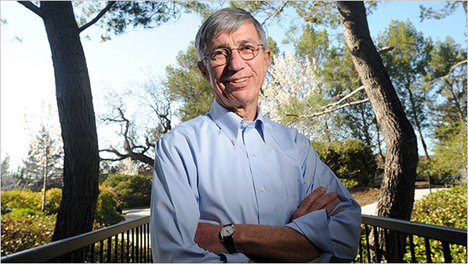

Professor Kulchytsky, though, would not go along.

The other day, as he stood before a new memorial to the victims of the famine, he recalled his decision as one turning point in a movement lasting decades to unearth the truth about that period. And the memorial itself, shaped like a towering candle with a golden eternal flame, seemed to him in some sense a culmination of this effort.

“It is a sign of our respect for the past,” Professor Kulchytsky said. “Because everyone was silent about the famine for many years. And when it became possible to talk about it, nothing was said. Three generations on.”

. . .

The pro-Western government in Kiev, which came to power after the Orange Revolution of 2004, calls the famine a genocide that Stalin ordered because he wanted to decimate the Ukrainian citizenry and snuff out aspirations for independence from Moscow.

The archives make plain that no other conclusion is possible, said Professor Kulchytsky, who is deputy director of the Institute of Ukrainian History in Kiev.

Professor Kulchytsky is 72, though he looks younger, as if he has somehow withstood the draining effect of so much research into the horrors of that time.

“It is difficult to bear,” he acknowledged. “The documents about cannibalism are especially difficult to read.”

Professor Kulchytsky said it was undeniable that people all over the Soviet Union died from hunger in 1932 and 1933 as the Communists waged war on the peasantry to create farming collectives. But he contended that in Ukraine the authorities went much further, essentially quarantining and starving many villages.

“If in other regions, people were hungry and died from famine, then here people were killed by hunger,” Professor Kulchytsky said. “That is the absolute difference.”

For the full story, see:

CLIFFORD J. LEVY. “Kiev Journal – A New View of a Famine That Killed Millions.” The New York Times (Mon., March 16, 2009): A6.

(Note: ellipsis added.)