On April 11, 2007 I posted an entry noting a new science fiction book with the title Creative Destruction. Not having read the book, I wondered aloud whether the book contained any reference to Schumpeter.

Yesterday (4/13/07), I was delighted to receive an email from the author of the book, answering my question. With his permission, I reproduce his email below:

Dr. Diamond,

I noticed your blog entry about Creative Destruction, my computer-themed SF collection. You asked: Does Schumpeter get a mention?

Absolutely. Here are the opening lines of the foreword:

If the Internet bubble had a patron saint, he was an obscure economist named Joseph Schumpeter.

Schumpeter owes his posthumous celebrity to two words: creative destruction. In 1942, he wrote of the "… Process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.

"Creative destruction," he said, "is the essential fact about capitalism." Every dotcom, of course, claimed its new technology would sweep out the old in a frenzy of creative destruction. Occasionally — think Yahoo! and Amazon — they were even correct.

The stories in the collection are most definitely science fiction — I have degrees in physics and computer science — but I also have an MBA from the University of Chicago.

Best regards,

– Ed Lerner

(Note: I have changed the format of the email, a little. The ellipsis was in the original.)

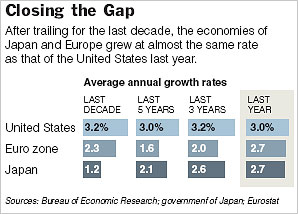

Source of the first and third graphic: the WSJ article cited above. Source of the second graphic: the NYT article cited above.

Source of the first and third graphic: the WSJ article cited above. Source of the second graphic: the NYT article cited above. Source of graphic: online version of the NYT article cited below.

Source of graphic: online version of the NYT article cited below.  Barney Frank. Source of photo:

Barney Frank. Source of photo:  Source of graph: online version of WSJ article cited below.

Source of graph: online version of WSJ article cited below.