(p. A13) Like the mythical monster Hydra–who grew two heads every time Hercules cut one off–President Obama, in both his State of the Union address and his new budget, has defiantly doubled down on his brand of industrial policy, the usually ill-advised attempt by governments to promote particular industries, companies and technologies at the expense of broad, evenhanded competition.

Despite his record of picking losers–witness the failed “clean energy” projects Solyndra, Ener1 and Beacon Power–Mr. Obama appears determined to continue pushing his brew of federal spending, regulations, mandates, special waivers, loan guarantees, subsidies and tax breaks for companies he deems worthy.

Favoring key constituencies with taxpayer money appeals to politicians, who can claim to be helping the overall economy, but it usually does far more harm than good. It crowds out valuable competing investment efforts financed by private investors, and it warps decisions by bureaucratic diktats susceptible to political cronyism. Former Obama adviser Larry Summers echoed most economists’ view when he warned the administration against federal loan guarantees to Solyndra, writing in a 2009 email that “the government is a crappy venture capitalist.”

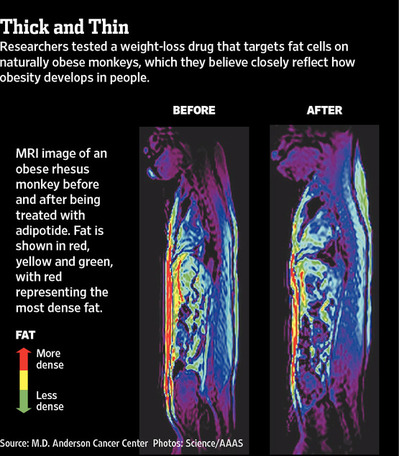

Adipotide Kills Fat Cells in Obese Mice and Monkeys

Source of graphic: online version of the WSJ article quoted and cited below.

(p. A6) A drug that kills a type of fat cell by choking off its blood supply caused significant weight loss in obese monkeys, potentially setting the stage for a new pharmaceutical approach to attacking obesity, according to a study released Wednesday.

After four weeks of treatment, obese monkeys given daily injections of the drug, called adipotide, lost an average of 11% of their body weight. They also had big reductions in waist circumference and body-mass index and, importantly, striking improvement in their ability to process insulin, researchers said. The drug had no effect on weight when given to lean monkeys.

Results of the study, performed at M.D. Anderson Cancer Center in Houston and published online by the journal Science Translational Medicine, confirmed a 2004 report from the same research team showing marked weight loss in mice treated with the agent.

. . .

The researchers’ 2004 paper showing a 30% weight loss in obese mice drew skepticism. Randy J. Seeley, director of the diabetes and obesity center at the University of Cincinnati, figured destroying white fat cells would make animals–and people–sick. But his own lab eventually replicated the mouse study, using rats instead, and now he is intrigued.

“This is really new stuff,” Dr. Seeley said of the latest results. “There’s no way to know if this will become a therapy or not, but at least it opens up a new way to think about therapies, and we have not had a lot of those.” He isn’t involved with the research.

For the full story, see:

RON WINSLOW. “Drug Offers Hope in Obesity Fight; Treatment Targeting Fat Cells Caused Significant Weight Loss in Monkeys; Human Trials to Begin Soon.” The Wall Street Journal (Thurs., November 10, 2011): A6.

(Note: ellipsis added.)

(Note: the last two sentences quoted above appeared in the online, but not the print, version of the article.)

“One of the monkeys used in the study. Obese monkeys lost an average of 11% of their body weight after four weeks of treatment.” Source of caption and photo: online version of the WSJ article quoted and cited above.

“One of the monkeys used in the study. Obese monkeys lost an average of 11% of their body weight after four weeks of treatment.” Source of caption and photo: online version of the WSJ article quoted and cited above.

“The Patience of Jobs”

(p. 7) Steve Jobs was missing from the scene of the meeting, though he would soon be Disney’s largest individual shareholder (the acquisition was a stock-for-stock trade) and the newest member of Disney’s board. Lasseter was right about his money; Jobs had driven a hard bargain in buying Lucas’s Computer Division for five million dollars (not ten million, as is sometimes reported), but as it turned out, he put ten times that amount into the company over the course of a decade to keep it afloat. Few other investors would have had the patience of Jobs.

Source:

Price, David A. The Pixar Touch: The Making of a Company. New York: Alfred A. Knopf, 2008.

(Note: my strong impression is that the pagination is the same for the 2008 hardback and the 2009 paperback editions, except for part of the epilogue, which is revised and expanded in the paperback. I believe the passage above has the same page number in both editions.)

Nasar Gives Compelling Portrait of Joseph Schumpeter and His Vienna

Source of book image: http://luxuryreading.com/wp-content/uploads/2011/10/grand-pursuit.jpg

(p. C31) Ms. Nasar gives us Belle Époque Vienna — infatuated with modernity and challenging London in the race to electrify with new telephone service, state-of-the-art factories and power-driven trams — and then a devastating picture of Vienna at the end of World War I: war veterans loitering outside restaurants waiting for scraps, and desperate members of a middle class that saw inflation wipe out all its savings trading a piano for a sack of flour, a gold watch chain for a few sacks of potatoes.

. . .

Among the more compelling portraits in this volume is that of Joseph Alois Schumpeter, the brilliant European economist who argued that the distinctive feature of capitalism was “incessant innovation” — a “perennial gale of creative destruction” — and who identified the entrepreneur as the visionary who could “revolutionize the pattern of production by exploiting an invention” or “an untried technological possibility.”

For the full review, see:

MICHIKO KAKUTANI. “BOOKS OF THE TIMES; The Economist’s Progress: Better Living Through Fiscal Chemistry.” The New York Times (Fri., December 2, 2011): C31.

(Note: ellipsis added.)

(Note: the online version of the article is dated December 1, 2011.)

Economic Freedom and Growth Depend on Protecting the Right to Rise

(p. A19) Congressman Paul Ryan recently coined a smart phrase to describe the core concept of economic freedom: “The right to rise.”

Think about it. We talk about the right to free speech, the right to bear arms, the right to assembly. The right to rise doesn’t seem like something we should have to protect.

But we do. We have to make it easier for people to do the things that allow them to rise. We have to let them compete. We need to let people fight for business. We need to let people take risks. We need to let people fail. We need to let people suffer the consequences of bad decisions. And we need to let people enjoy the fruits of good decisions, even good luck.

That is what economic freedom looks like. Freedom to succeed as well as to fail, freedom to do something or nothing. . . .

. . .

But when it comes to economic freedom, we are less forgiving of the cycles of growth and loss, of trial and error, and of failure and success that are part of the realities of the marketplace and life itself.

. . .

. . . , we must choose between the straight line promised by the statists and the jagged line of economic freedom. The straight line of gradual and controlled growth is what the statists promise but can never deliver. The jagged line offers no guarantees but has a powerful record of delivering the most prosperity and the most opportunity to the most people. We cannot possibly know in advance what freedom promises for 312 million individuals. But unless we are willing to explore the jagged line of freedom, we will be stuck with the straight line. And the straight line, it turns out, is a flat line.

For the full commentary, see:

JEB BUSH. “OPINION; Capitalism and the Right to Rise; In freedom lies the risk of failure. But in statism lies the certainty of stagnation.” The Wall Street Journal (Mon., December 19, 2011): A19.

(Note: ellipses added.)

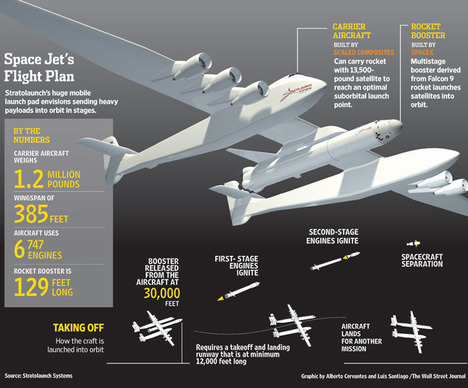

Paul Allen Uses Microsoft Profits for Bold Private Space Project

Source of graphic: online version of the WSJ article quoted and cited below.

Source of graphic: online version of the WSJ article quoted and cited below.

(p. B1) Microsoft Corp. co-founder Paul Allen indicated he is prepared to commit $200 million or more of his wealth to build the world’s largest airplane as a mobile platform for launching satellites at low cost, which he believes could transform the space industry.

Announced Tuesday, the novel, high-risk project conceived by renowned aerospace designer Burt Rutan seeks to combine engines, landing gears and other parts removed from old Boeing 747 jets with a newly created composite craft from Mr. Rutan and a powerful rocket to be built by a company run by Internet billionaire and commercial-space pioneer Elon Musk.

Dubbed Stratolaunch and funded by one of Mr. Allen’s closely held entities, the venture seeks to meld decades-old airplane technology with cutting-edge booster-rocket designs in an unprecedented way to assemble a hybrid that would offer the first totally privately funded space transportation system.

“What Success Had Brought Him, . . . , Was Freedom”

(p. 5) The success of Pixar’s films had brought him something exceedingly rare in Hollywood: not the house with the obligatory pool in the backyard and the Oscar statuettes on the fireplace mantel, or the country estate, or the vintage Jaguar roadster–although he had all of those things, too. It wasn’t that he could afford to indulge his affinity for model railroads by acquiring a full-size 1901 steam locomotive, with plans to run it on the future site of his twenty-thousand-square-foot mansion in Sonoma Valley wine country. (Even Walt Dìsney’s backyard train had been a mere one-eighth-scale replica.)

None of these was the truly important fruit of Lasseter’s achievements. What success had brought him, most meaningfully, was freedom. Having created a new genre of film with his colleagues at Pixar, he had been able to make the films he wanted to make, and he was coming back to Disney on his own terms.

Source:

Price, David A. The Pixar Touch: The Making of a Company. New York: Alfred A. Knopf, 2008.

(Note: ellipsis in title was added.)

(Note: my strong impression is that the pagination is the same for the 2008 hardback and the 2009 paperback editions, except for part of the epilogue, which is revised and expanded in the paperback. I believe the passage above has the same page number in both editions.)

“Human Progress Is Built on Man’s Desire to Correct His Mistakes”

Source of book image: online version of the WSJ review quoted and cited below.

(p. A17) Yu Hua is one of China’s most acclaimed novelists, hugely popular in his own country and the recipient of several international literary prizes. He brings a novelist’s sensibility to “China in Ten Words,” his first work of nonfiction to be published in English. This short book is part personal memoir about the Cultural Revolution and part meditation on ordinary life in China today. It is also a wake-up call about widespread social discontent that has the potential to explode in an ugly way.

. . .

Mr. Yu argues that corruption infects every aspect of modern Chinese society, including the legal system. Historically, Chinese peasants with grievances could go to the capital and petition the emperor for redress. Today, Mr. Yu writes, millions–yes, millions–of desperate citizens flock to Beijing each year hoping to find an honest official who will dispense justice where the law has failed them at home. What will happen when they discover that their leaders at the national level are just as corrupt as those at the local level?

The violence and deprivations of the Cultural Revolution are by now well known, but Mr. Yu’s reminiscences add color and texture to what the world has learned in recent years about that lost decade. The youthful Yu Hua is something of a wise guy and a schemer, pitting himself against bureaucratic inanities. It is sometimes impossible to know whether to laugh or cry.

. . .

As awful as the Cultural Revolution was, in Mr. Yu’s telling its horrors sometimes pale next to those of the present day. The chapter on “bamboozle” describes how trickery, fraud and deceit have become a way of life in modern China. “There is a breakdown of social morality and a confusion in the value system of China today,” he states. He writes, for example, about householders around the country who are evicted from their homes on the orders of unscrupulous, all-powerful local officials.

Mr. Yu’s portrait of contemporary Chinese society is deeply pessimistic. The competition is so intense that, for most people, he says, survival is “like war.” He has few hopeful words to offer, other than to quote the ancient philosopher Mencius, who taught that human progress is built on man’s desire to correct his mistakes. Meanwhile, he writes, “China’s pain is mine.”

For the full review, see:

MELANIE KIRKPATRICK. “BOOKSHELF; Cultural Lexicon; People, leader, reading, revolution, disparity, copycat and bamboozle–some words that serve as a springboard for critiques of China.” The Wall Street Journal (Weds., December 7, 2011): A17.

(Note: ellipses added.)

The book under review is:

Yu, Hua. China in Ten Words. New York: Pantheon Books, 2011.

Married Batters Paid More than Equally Good Bachelor Batters

(p. C4) Many studies have found that married men earn more than their single peers, but whether they’re actually more productive is harder to answer. To settle the question, researchers looked to baseball.

They took a random sample of nearly 3,500 pro hitters, from 1871 through 2007, comparing their batting averages and other statistics with their salaries (as revealed in MLB archives and other sources). Until 1975, when the market for players became freer, there was no link between marriage, productivity and earnings. After 1975, there was some evidence that hitters who begin their careers in the bottom third of the ability spectrum gained a handful of points in batting average when they married, and a bit of salary, but the evidence was statistically weak.

For the full summary, see:

Christopher Shea. “Marriage Moneyball.” The Wall Street Journal (Sat., NOVEMBER 5, 2011): C4.

The paper summarized is:

Cornaglia, Francesca, and Naomi E. Feldman. “Productivity, Wages, and Marriage: The Case of Major League Baseball.” CEP Discussion Paper # 1081, September 2011.

Marco Rubio’s Parents Worked Hard so He Could Do Something He Loves

Marco Rubio. Source of photo: online version of the NYT article quoted and cited below.

(p. 10) Your parents came to Miami from Cuba in the 1950s. Your dad became a bartender, and your mom worked as a hotel maid, among other jobs. Was it always clear that you wouldn’t follow them into a service job?

The service industry is hard, honorable work, but early on my parents drove it into us that a job is what you do to make a living; a career is when you get paid to do something that you love. They had jobs so I could have a career.

. . .

Koch Industries, Goldman Sachs and Morgan Stanley are among your top career campaign contributors. What do you say to people who believe that they’re investing in you so that you’ll push to overhaul the tax code to their benefit?

People buy into my agenda. I don’t buy into anyone’s agenda. I tell people what I stand for, and the things I’ve stood for were the same at the very beginning, when none of those people were giving me money.

For the full interview, see:

ANDREW GOLDMAN, interviewer. “TALK; Marco Rubio Won’t Be V.P.” The New York Times Magazine (Sun., January 29, 2012): 10.

(Note: ellipsis added; bold in original.)

(Note: the online version of the interview has the date January 26, 2012.)

Even Krugman Worries that China Faces “Economic Crisis”

China’s economy is often touted as an exemplar of the success of government stimulus policies at promoting economic growth. So it is worth noting when a Nobel-Prize-winning international economist and advocate of government stimulus policies worries that in China:

(p. A25) . . . the bubble is bursting — and there are real reasons to fear financial and economic crisis.

. . .

I’ve been reluctant to weigh in on the Chinese situation, in part because it’s so hard to know what’s really happening. All economic statistics are best seen as a peculiarly boring form of science fiction, but China’s numbers are more fictional than most. I’d turn to real China experts for guidance, but no two experts seem to be telling the same story.Still, even the official data are troubling — and recent news is sufficiently dramatic to ring alarm bells.

. . .

Real estate investment has roughly doubled as a share of G.D.P. since 2000, accounting directly for more than half of the overall rise in investment. And surely much of the rest of the increase was from firms expanding to sell to the burgeoning construction industry.

Do we actually know that real estate was a bubble? It exhibited all the signs: not just rising prices, but also the kind of speculative fever all too familiar from our own experiences just a few years back — think coastal Florida.

. . .

For what it’s worth, statements about economic policy from Chinese officials don’t strike me as being especially clear-headed. In particular, the way China has been lashing out at foreigners — among other things, imposing a punitive tariff on imports of U.S.-made autos that will do nothing to help its economy but will help poison trade relations — does not sound like a mature government that knows what it’s doing.

And anecdotal evidence suggests that while China’s government may not be constrained by rule of law, it is constrained by pervasive corruption, which means that what actually happens at the local level may bear little resemblance to what is ordered in Beijing.

For the full commentary, see:

PAUL KRUGMAN. “Will China Break?” The New York Times (Mon., December 19, 2011): A25.

(Note: ellipses added.)

(Note: the online version of the story is dated December 18, 2011.)