Sounds like a possible example of Clayton Christensen’s where the incumbent (movie theaters) move up-market in response to the threat from the disruptive technology (increasingly high quality home entertainment systems):

It was Saturday night at the Palace 20, a huge megaplex here designed in an ornate, Mediterranean style and suggesting the ambience of a Las Vegas hotel. Moviegoers by the hundreds were keeping the valet parkers busy, pulling into the porte-cochere beneath the enormous chandelier-style lamps. Entering the capacious lobby, some of them dropped off their small children in a supervised playroom and proceeded to a vast concession stand for a quick meal of pizza or popcorn shrimp before the show.

Others, who had arrived early for their screening of, say, ”Wedding Crashers” or ”The Dukes of Hazzard” — their reserved-seat tickets, ordered online and printed out at home, in hand — entered through a separate door. They paid $18 — twice the regular ticket price (though it included free popcorn and valet service) — and took an escalator upstairs to the bar and restaurant, where the monkfish was excellent and no one under 21 was allowed.

Those who didn’t want a whole dinner, or arrived too late for a sit-down meal, lined up at the special concession stand, where the menu included shrimp cocktail and sushi and half bottles of white zinfandel and pinot noir. As it got close to curtain time, they took their food and drink into one of the adjoining six theater balconies, all with plush wide seats and small tables with sunken cup holders. During the film, the most irritating sound was the clink of ice in real glasses.

Not your image of moviegoing? Pretty soon it might be. At a time when movie attendance is flagging, when home entertainment is offering increasing competition and when the largest theater chains — Regal Entertainment, AMC Entertainment (which has recently announced a merger with Loews Cineplex) and Cinemark — are focused on shifting from film to digital projection, a handful of smaller companies with names like Muvico Theaters, Rave Motion Pictures and National Amusements are busy rethinking what it means to go to the movie theater. (B1)

BRUCE WEBER. “Liked the Movie, Loved the Megaplex; Smaller Theater Chains Lure Adults With Bars, Dinner and Luxury.” The New York Times (Wednesday, August 17, 2005): B1 & B7.

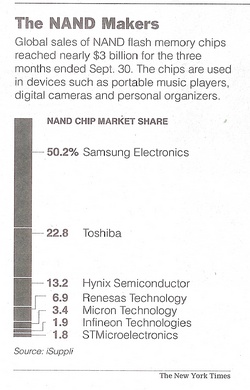

Source of table: online version of WSJ article cited below.

Source of table: online version of WSJ article cited below.