Source of graphic: online version of the WSJ article quoted and cited below.

Source of graphic: online version of the WSJ article quoted and cited below.

Cancellations due to mechanical failures, piliot illness and government regulations are often announced as though they were acts of God, outside the possible control of airlines, for which the airline is blameless. But airlines can take actions, and improve processes, to reduce the frequency and consequences of such cancellations. In airlines, and in other firms, there is not a sharp line between what can and what cannot be under the firm’s control.

(p. D3) Atlanta

The crew of Delta Air Lines Flight 55 last Thursday couldn’t legally fly from Lagos, Nigeria, to Atlanta unless they waited a day due to new limits on how much pilots can fly in a rolling 28-day period. The trip would have to be canceled.

Instead, Delta headquarters told the captain to fly to San Juan, Puerto Rico, which they could reach within their duty limits. There, two new pilots would be waiting to take the Boeing 767 on to Atlanta. The plane arrived in San Juan at 2:44 a.m., quickly took on fuel and pilots, and landed in Atlanta only 40 minutes late.

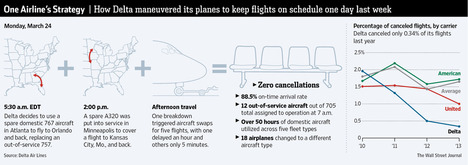

The episode, unorthodox in the airline industry, illustrates the fanaticism Delta now has for avoiding cancellations. Last year, Delta canceled just 0.3% of its flights, according to flight-tracking service FlightStats.com. That was twice as good as the next-best airlines, Southwest and Alaska, and five times better than the industry average of 1.7%.

. . .

Managers in Delta operations centers move planes, crews and parts around hourly trying to avoid canceling flights. How well an airline maintains its fleet and how smartly it stashes spare parts and planes at airports affect whether your flight goes or not.

Delta thinks it has come up with new analytical software and instruments that can help monitor the health of airplanes and predict which parts will soon fail. Empty planes are ferried to replace crippled jets rather than waiting for overnight repairs.

Mechanics developed a vibration monitor to install on cooling fans for cockpit instruments. A plane can’t be sent out on a new trip with a broken fan.

Now when vibration starts to increase, indicating that a bearing may be wearing down and getting close to failing, a new fan is swapped in. The wobbly fan goes to the shop for new bearings. That has reduced canceled flights.

So has spending $2 million to have spare starters for Boeing 767 engines at all 767 stations abroad. Starters last about five years. While each plane has two and both engines can be started with one, you can’t send a plane out on a long trip over oceans with only one working.

For the full story, see:

SCOTT MCCARTNEY. “THE MIDDLE SEAT; A World Where Flights Aren’t Canceled; How Smartly an Airline Stashes Spare Parts and Planes at Airports Affects Whether or Not Your Flight Takes Off.” The Wall Street Journal (Thurs., April 3, 2014): D3.

(Note: ellipsis added.)

(Note: the online version of the story was updated April 2, 2014, and has the title “THE MIDDLE SEAT; A World Where Flights Aren’t Canceled; Inside Delta’s new strategies to avoid stranding fliers.”)