Two years ago the World Bank’s environmental economics department set out to assess the relative contributions of various kinds of capital to economic development. Its study, "Where is the Wealth of Nations?: Measuring Capital for the 21st Century," began by defining natural capital as the sum of nonrenewable resources (including oil, natural gas, coal and mineral resources), cropland, pasture land, forested areas and protected areas. Produced, or built, capital is what many of us think of when we think of capital: the sum of machinery, equipment, and structures (including infrastructure) and urban land.

But once the value of all these are added up, the economists found something big was still missing: the vast majority of world’s wealth! If one simply adds up the current value of a country’s natural resources and produced, or built, capital, there’s no way that can account for that country’s level of income.

The rest is the result of "intangible" factors — such as the trust among people in a society, an efficient judicial system, clear property rights and effective government. All this intangible capital also boosts the productivity of labor and results in higher total wealth. In fact, the World Bank finds, "Human capital and the value of institutions (as measured by rule of law) constitute the largest share of wealth in virtually all countries."

Once one takes into account all of the world’s natural resources and produced capital, 80% of the wealth of rich countries and 60% of the wealth of poor countries is of this intangible type. The bottom line: "Rich countries are largely rich because of the skills of their populations and the quality of the institutions supporting economic activity."

For the full commentary, see:

Some of the crew of Gruz 200, including the director Alexei Balabanov, who is second from the left. Source of the photo: online version of the WSJ article cited below.

Some of the crew of Gruz 200, including the director Alexei Balabanov, who is second from the left. Source of the photo: online version of the WSJ article cited below. The sadistic police captain is portrayed by Alexei Poluyan. Source of the photo: online version of the WSJ article cited above.

The sadistic police captain is portrayed by Alexei Poluyan. Source of the photo: online version of the WSJ article cited above.

(Note: ellipsis in Rearden quote was in original; the other two ellipses were added.)

(Note: ellipsis in Rearden quote was in original; the other two ellipses were added.)

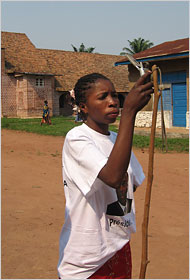

"Micheline Kapinga of Kamponde, Congo, uses a cellphone on the only site in the village that is sometimes able to capture a signal." Source of caption and photo: online version of the NYT article cited below.

"Micheline Kapinga of Kamponde, Congo, uses a cellphone on the only site in the village that is sometimes able to capture a signal." Source of caption and photo: online version of the NYT article cited below.