November 9, 1952 NYT ad announcing the introduction of the snowblower. Source of image: online version of the NYT article cited below.

November 9, 1952 NYT ad announcing the introduction of the snowblower. Source of image: online version of the NYT article cited below.

(p. C1) When the first snow falls on the North Shore of Chicago this winter, Robert Gordon will take his Toro snow blower out of the garage and think about how lucky he is not to be using a shovel. Mr. Gordon is 66 years old and evidently quite healthy, but his doctor has told him that he should never clear his driveway with his own hands. “People can die from shoveling snow,” Mr. Gordon said. “I bet a lot of lives have been saved by snow blowers.”

If so, most of them have been saved in the last few decades. A Canadian teenager named Arthur Sicard came up with the idea for the snow blower in the late 1800’s, while watching the blades on a piece of farm equipment, but he didn’t sell any until 1927. For the next 30 years or so, snow blowers were hulking machines typically bought by cities and schools. Only recently have they become a suburban staple.

Yet the benefits of the snow blower, namely more free time and less health risk, are largely missing from the government’s attempts to determine Americans’ economic well-being. The same goes for dozens of other inventions, be they air-conditioners, cellphones or medical devices. The reasons are a little technical — they involve the measurement of inflation — but they’re important to understand, because the implications are so large.

. . .

(p. C10) In the early 1950’s, Toro began selling mass-market snow blowers, which weighed up to 500 pounds and cost at least $150. As far as the Bureau of the Labor Statistics was concerned, however, snow blowers did not exist until 1978. That was the year when the machines began to be counted in the Consumer Price Index, the source of the official inflation rate. By then, the cheapest model sold for about $100.

In practical terms, this was an enormous price decline compared with the 1950’s, because incomes had risen enormously over this period. Yet the price index completely missed it and, by doing so, overstated inflation. It counted the rising cost of cars and groceries but not the falling cost of snow blowers.

. . .

Mr. Gordon, besides being a fan of snow blowers, also happens to be one of the country’s leading macroeconomists. A decade ago he served on a government-appointed group known as the Boskin Commission. It argued, as Mr. Gordon still does, that the government exaggerated inflation by more than one percentage point every year.

. . .

. . . Mr. Gordon’s adjustments show that men actually got a 27 percent raise in this period and women 65 percent. The gains are not as big as those of the 1950’s and 60’s, but they do sound far more realistic than the official numbers. Think about it: we live longer than people did in the 1970’s, we’re healthier while alive, we graduate from college in much greater numbers, we’re surrounded by new gadgets and we live in bigger houses. Is it really plausible, as some Democrats claim, that the middle class has made only marginal progress?

For the full commentary, see:

DAVID LEONHARDT. "Economix; Life Is Better; It Isn’t Better. Which Is It?" The New York Times (Weds., September 20, 2006): C1 & C10.

(Note: ellipsis added.)

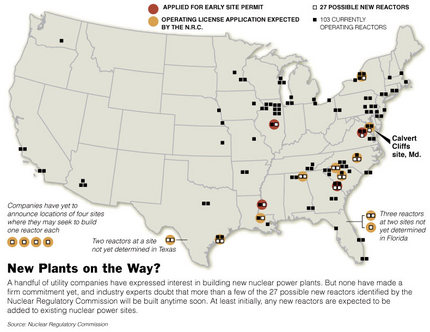

Source of graphic: online version of the NYT article cited above.

Source of graphic: online version of the NYT article cited above.

W tours one of Constellation Energy’s current nuclear power plants. Source of the photo: online version of the NYT article cited below.

W tours one of Constellation Energy’s current nuclear power plants. Source of the photo: online version of the NYT article cited below.  Source of map graphic: online version of the NYT article cited above.

Source of map graphic: online version of the NYT article cited above.

Source of graphic: online version of the NYT article cited above.

Source of graphic: online version of the NYT article cited above.

Source of graphic: online version of the WSJ article cited below.

Source of graphic: online version of the WSJ article cited below.