“Traders in the oil futures pit of the New York Mercantile Exchange on Tuesday” (January 22. 2008). Source of caption and photo: online version of the NYT commentary quoted and cited below.

“Traders in the oil futures pit of the New York Mercantile Exchange on Tuesday” (January 22. 2008). Source of caption and photo: online version of the NYT commentary quoted and cited below.

Raghuram Rajan is mentioned in the article quoted below. I first ran across him as the co-author of a book that was billed as applying Schumpeterian ideas of creative destruction to issues of economic growth and development.

Then, at the American Economic Association meetings in New Orleans in early January, I was on my way to a History of Economics Society reception, when I stumbled by chance into a modest reception in which Rajan was giving an informal speech on the subprime mortgage crisis.

It was such an interesting presentation, that I ended up totally missing the History of Economics Society reception. Rajan argued that the main problem was one of misguided incentives. Bonuses at top investment firms like Merrrill Lynch and JPMorgan Chase, are supposed to go to those whose investments produce high returns, with modest risks. The problem with the complicated securities based on the subprime mortgages was that they produced high returns, but the risks were actually also fairly high. The high-flying investors probably had some knowledge of this, but the public did not. In most years the investors could invest in the high return, but high risk, securities, and collect huge bonuses. But now the chickens have come home to roost.

Rajan suggested that the answer would be a change in the way in which the traders are given bonuses. Instead of handing them out annually, let them become vested only after observing the investment’s track record for several years. If the investment goes south before the bonus is vested, the trader does not get the bonus. This would provide an incentive and reward for those who accurately accessed the risk of their investments.

(p. A1) . . . , Wall Street hasn’t yet come clean. Even after last week, when JPMorgan Chase and Wells Fargo announced big losses in their consumer credit businesses, financial service firms have still probably gone public with less than half of their mortgage-related losses, according to Moody’s Economy.com. They’re not being dishonest; they just haven’t untangled all of their complex investments.

“Part of the big uncertainty,” Raghuram G. Rajan, former chief economist at the International Monetary Fund, said, “is where the bodies are buried.”

As Mr. Rajan pointed out, this situation is more severe than the crisis involving Long Term Capital Management in the late 1990s. That was a case in which a limited set of bad investments, largely at one firm, had the potential to drive down the value of other firms’ holdings in the short term. Those firms then might have stopped lending money because they no longer had the capital to do so. But their own balance sheets were largely healthy.

This time, the firms are facing real losses, which will almost certainly curtail lending, and economic growth, this year.

For the full commentary, see:

DAVID LEONHARDT. “ECONOMIC SCENE; Worries That the Good Times Were Mostly a Mirage.” The New York Times (Weds., January 23, 2008): A1 & A23.

(Note: ellipsis added.)

The Schumpeterian book co-authored by Rajan, is:

Rajan, Raghuram G., and Luigi Zingales. Saving Capitalism from the Capitalists: Unleashing the Power of Financial Markets to Create Wealth and Spread Opportunity. New York: Crown, 2003.

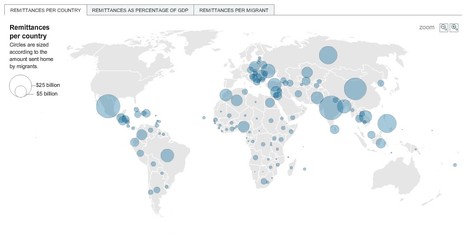

Source of graph: online version of the NYT article quoted and cited below.

Source of graph: online version of the NYT article quoted and cited below.

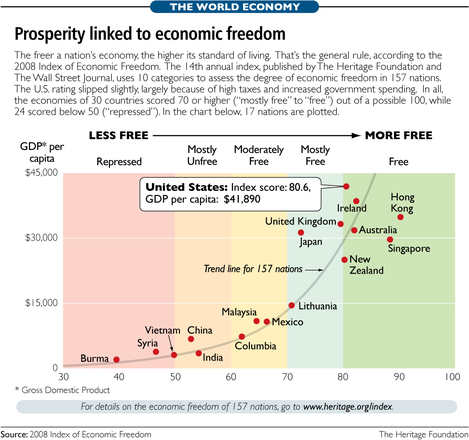

Source of table: online version of the WSJ article quoted and cited above.

Source of table: online version of the WSJ article quoted and cited above.

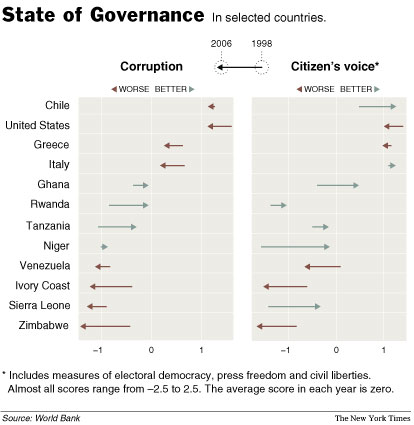

Source of graph: online version of the NYT article quoted and cited below.

Source of graph: online version of the NYT article quoted and cited below.

Source of table: "World Publics Welcome Global Trade — But Not Immigration." Pew Global Attitudes Project, a project of the PewResearchCenter. Released: 10.04.07 dowloaded from:

Source of table: "World Publics Welcome Global Trade — But Not Immigration." Pew Global Attitudes Project, a project of the PewResearchCenter. Released: 10.04.07 dowloaded from: