In Mexico City, protesters complain about the high price of tortillas and other corn-based food staples. Source of photo: online version of the NYT article cited below.

In Mexico City, protesters complain about the high price of tortillas and other corn-based food staples. Source of photo: online version of the NYT article cited below.

Support for the free market is very fragile in places like Mexico. Calderón won a close election, and is, by all accounts, an advocate for the free market. So it is sad that United States government subsides for ethanol result in pain in Mexico that makes it harder for Calderon to effectively move Mexico toward the free market, and a better life for the Mexican people.

So do we blame Bush for coming out for ethanol in his State of the Union address on Tuesday (1/23/07)? Well maybe Bush can only afford to fight the political trends on one or two issues. And he has seen the war against terrorism as the big issue of our time. On that he is right.

So while we can see why political survival may force Bush into support of ethanol, and Calderón into support for price controls on tortillas, we still need to identify policies that are inefficient and wrong.

Subsidies on ethanol, and price controls on corn, are inefficient. And inefficiency means that the economy produces less, and grows more slowly, and lives are lived less well.

MEXICO CITY, Jan. 18 — Facing public outrage over the soaring price of tortillas, President Felipe Calderón abandoned his free-trade principles on Thursday and forced producers to sign an agreement fixing prices for corn products.

Skyrocketing prices for corn on the world market have pushed up the price of the humble tortilla, the mainstay of the Mexican diet, by nearly a third in the past three weeks, to 35 cents a pound in Mexico City and even higher in other parts of the country.

Half of the country’s 107 million people live on $4 a day or less, and many of them survive largely on tortillas and beans. The price increases have riled the public to such an extent that it has created a political storm that threatens to swamp Mr. Calderón’s fresh presidency.

This month, the president, who took office in December, was booed and heckled at events around the country over food prices. Mexican lawmakers called on him to impose price controls, while leftist opposition leaders suggested that he was protecting giant corn companies.

. . .

There is a continuing debate here about what caused the price of tortillas to shoot up so quickly. Some economists blame the increased demand for corn from ethanol plants in the United States, and it is true corn prices in the States last week reached their highest point in a decade, the United States Agriculture Department said. At the same time, the cost of white corn has risen about 13 percent here over the past year, Mexican government figures show.

. . .

The spike in corn prices has hurt small storefront tortilla makers, a hallmark of the Mexican street. José Solano, a 27-year-old tortilla maker in Mexico City, said he had lost about 40 percent of his business since early January, when he was forced to start raising his prices.

“People are still buying tortillas, but many of them buy less,” he said. “Look, we can’t give our product away because we need a profit, and if they raise the cost of corn, there’s no other way.”

The crisis has hit hardest for the poorest Mexicans, who may spend more than a quarter of their daily salaries on tortillas.

“This really affects my budget, the expenses of my family, because I cannot tell my kids to eat less,” said Ruth Soria, a 37-year-old housewife, who was buying four pounds of tortillas for her six children on Thursday. “This is something that they must control well. The tortilla is something basic for us. What the government did today is the least they could do.”

JAMES C. McKINLEY, Jr. "Cost of Corn Soars, Forcing Mexico to Set Price Limits." The New York Times (Fri., January 19, 2007): A11.

Calderón on right shakes the hand (and picks the pocket?) of Roberto González, who is the head of Gruma, one of Mexico’s large tortilla and corn flour distributors. Source of photo: online version of the NYT article cited below.

Calderón on right shakes the hand (and picks the pocket?) of Roberto González, who is the head of Gruma, one of Mexico’s large tortilla and corn flour distributors. Source of photo: online version of the NYT article cited below.

Source of graph: online version of the WSJ article cited below.

Source of graph: online version of the WSJ article cited below.

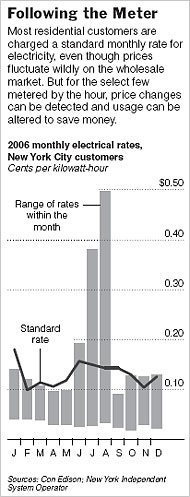

Graph showing the range of variation in hourly electricity rates in different months. Source of graphic: online version of the NYT article cited above.

Graph showing the range of variation in hourly electricity rates in different months. Source of graphic: online version of the NYT article cited above.