Part of a Greenpeace ad lambasting Senator Edward Kennedy’s opposition to windmills that would effect his view. Source of image of part of ad: online version of the WSJ article quoted and cited below.

Part of a Greenpeace ad lambasting Senator Edward Kennedy’s opposition to windmills that would effect his view. Source of image of part of ad: online version of the WSJ article quoted and cited below.

(p. W8) Behind much of the modern environmental movement lies the "do as I say, not as I do" sensibility of an aristocracy. It’s not surprising when a bunch of enviro-aristos line up opposition to a new road or a shopping mall or some other development that offends them. But there is something delicious about such obstructionists raising environmental concerns — almost all of them bogus — to try to prevent a wind farm, one of the cleanest sources of electricity we have, from being built in sight of their summer homes.

. . .

Sen. Kennedy presented the spectacle of working hard behind the scenes to sabotage the wind farm while publicly castigating the Bush administration for its alleged failure to push environmental technology.

. . .

The real outrage here is the agonizing delay in gaining approval for Cape Wind — all too typical, alas, of how things work, or don’t, in Massachusetts. A not-in-my-backyard campaign ought to target something at least potentially unpleasant, but the "visual pollution" that so angered Mr. McCullough would be minuscule. From Sen. Kennedy’s compound five miles away, a 417-foot tower appears about as tall as the thumbnail at the end of your outstretched arm. It makes you wonder how Cape Wind’s opponents would react if a developer planned a pharmaceutical factory in, say, Hyannis — civil disobedience, perhaps? Exquisitely catered, of course.

For the full review, see:

GUY DARST. "You’re Blocking My View." The Wall Street Journal (Fril, May 25, 2007): W8.

(Note: ellipses added.)

Source of the book image: http://ec1.images-amazon.com/images/I/51p+cPVSstL._SS500_.jpg

Source of the book image: http://ec1.images-amazon.com/images/I/51p+cPVSstL._SS500_.jpg

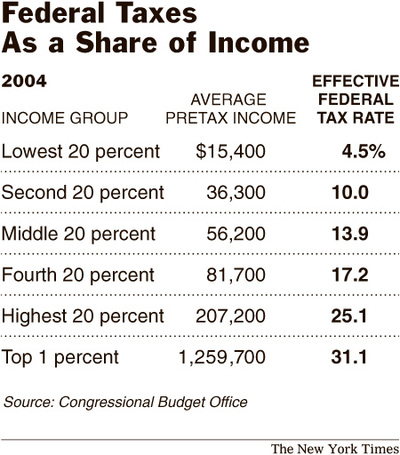

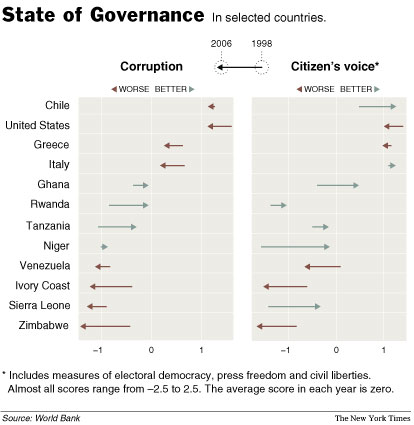

Source of graphic: online version of the WSJ article quoted and cited below.

Source of graphic: online version of the WSJ article quoted and cited below.

Sugar beats unloaded in Scottsbluff, Nebraska at Western Sugar in 1999. Source of photo: online version of the Omaha World-Herald article cited below.

Sugar beats unloaded in Scottsbluff, Nebraska at Western Sugar in 1999. Source of photo: online version of the Omaha World-Herald article cited below. Source of graph: online version of the NYT article quoted and cited below.

Source of graph: online version of the NYT article quoted and cited below.