The Chamber of Commerce, long a supporter of limited government and low taxes, was part of the coalition backing the Reagan revolution in the 1980s. On the national level, the organization still follows a pro-growth agenda — but thanks to an astonishing political transformation, many chambers of commerce on the state and local level have been abandoning these goals. They’re becoming, in effect, lobbyists for big government.

. . .

In as many as half the states, state taxpayer organizations, free market think tanks and small business leaders now complain bitterly that, on a wide range of issues, chambers of commerce deploy their financial resources and lobbying clout to expand the taxing, spending and regulatory authorities of government. This behavior, they note, erodes the very pro-growth climate necessary for businesses — at least those not connected at the hip with government — to prosper. Journalist Tim Carney agrees: All too often, he notes in his recent book, "Rip-Off," "state and local chambers have become corrupted by the lure of big dollar corporate welfare schemes."

. . .

The U.S. Chamber of Commerce boasts that the organization’s "core mission is to fight for business and free enterprise before Congress, the White House, regulatory agencies . . . and governments around the world." The national chamber has done just that, pushing tort reform and free trade — but in the states, chambers have come to believe their primary function is to secure tax financing for sports stadiums, convention centers, high-tech research institutes and transit boondoggles. Some local chambers have reportedly asked local utilities, school administrators and even politicians to join; others have opened membership to arts councils, museums, civic associations and other "tax eater" entities.

. . .

"I used to think that public employee unions like the NEA were the main enemy in the struggle for limited government, competition and private sector solutions," says Mr. Caldera of the Independence Institute. "I was wrong. Our biggest adversary is the special interest business cartel that labels itself ‘the business community’ and its political machine run by chambers and other industry associations."

For the full commentary, see:

STEPHEN MOORE. "Tax Chambers." The Wall Street Journal (Sat., February 10, 2007): A8.

(Note: ellipses added, except the one in the quote following the word "agencies.")

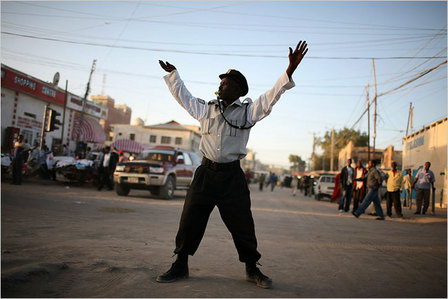

Top photo shows women selling jewelry. Middle photo shows a traffic cop performing a defensible function of government. At bottom, the map shows Somaliland relative to the rest of Somalia. Source of photos and map: online version of the NYT article cited above.

Top photo shows women selling jewelry. Middle photo shows a traffic cop performing a defensible function of government. At bottom, the map shows Somaliland relative to the rest of Somalia. Source of photos and map: online version of the NYT article cited above.

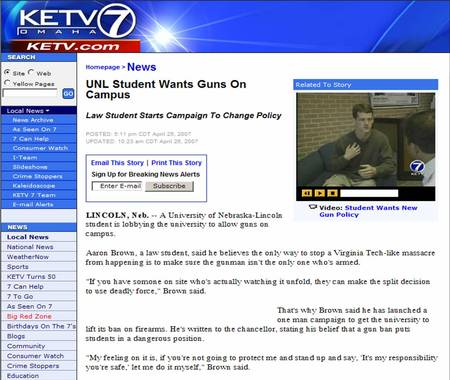

"John Edwards appearing at a public forum in Council Bluffs, Iowa, on March 9, two days after one of his $400 haircuts." Source of caption and photo: online version of the NYT article cited below.

"John Edwards appearing at a public forum in Council Bluffs, Iowa, on March 9, two days after one of his $400 haircuts." Source of caption and photo: online version of the NYT article cited below.