“The company was founded with the thought that a recession would happen,” said Grant Stanley, founder of marketing analytics firm Contemporary Analysis.” Source of caption and photo: online version of the Omaha World-Herald article quoted and cited below.

Grant was a student in my Economics of Technology and Economics of Entrepreneurship classes; Tadd was a student in my Honors Colloquium on Creative Destruction; Luis was a student in my Principle of Economics–Micro class. They have chosen an exciting path, and I wish them well!

(p. 1D) Grant Stanley was studying economics at the University of Nebraska at Omaha last year when he identified a business opportunity in the deteriorating economy.

A company making use of econometrics – a field that combines math, statistics and economics – could help small and midsize businesses make decisions in areas such as hiring, and sales and marketing techniques. Econometrics is widely used in education, government and large companies, Stanley said, but usually isn’t applied to smaller businesses.

Stanley thought the need for business forecasting and marketing analytics firms would grow as companies looked for help developing long-term strategies in order to survive an economic downturn.

So Stanley, who was only 20 years old at the time, started Contemporary Analysis, a marketing analytics firm, in March 2008.

“The company was founded with the thought that a recession would happen.”

Stanley courted classmate Tadd Wood, who also was 20 and studying economics, to help start the business, but it wasn’t an easy task. Wood already had a part-time job and was helping out in his family’s business.

“Tadd took months of, ‘Hey, want to hang out?'” before he agreed, Stanley said.

The young men met their third partner – Luis Lopez, 20 – through a friend over the summer, and the trio hit the ground running.

For the full story, see:

STEFANIE MONGE. “Pitching a startup in a downturn.” Omaha World-Herald (Monday, February 2, 2009): 1D & 3D.

“Members of the Contemporary Analysis team at a conference table in the home of Paddy Tarlton. From left are Luis Lopez, Nancy Jimenez, Grant Stanley, Tarlton and Tadd Wood.” Source of caption and photo: online version of the Omaha World-Herald article quoted and cited above.

“Members of the Contemporary Analysis team at a conference table in the home of Paddy Tarlton. From left are Luis Lopez, Nancy Jimenez, Grant Stanley, Tarlton and Tadd Wood.” Source of caption and photo: online version of the Omaha World-Herald article quoted and cited above.

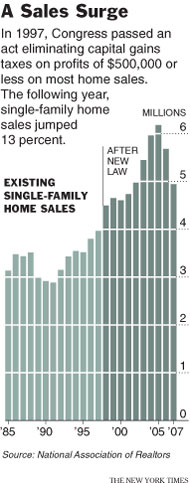

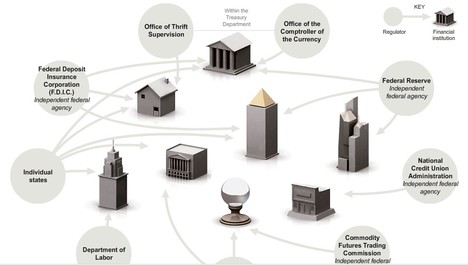

Source of graphic: online version of the NYT article quoted and cited below.

Source of graphic: online version of the NYT article quoted and cited below.